Demand is increasing. Production is almost completely dominated by China. Recycling margins are inadequate. This is the current context of the market of Rare Earth Elements (REE) or “technology metals” which are essential for a wide range of applications, from smartphones, to microphones, electric and hybrid vehicles, headphones, earphones and X-ray machines, to name just a few.

However, while the demand for Rare Earth Elements, and their price, is subject to significant fluctuations, reuse is virtually impossible because of their low return and the high costs of the recovery process.

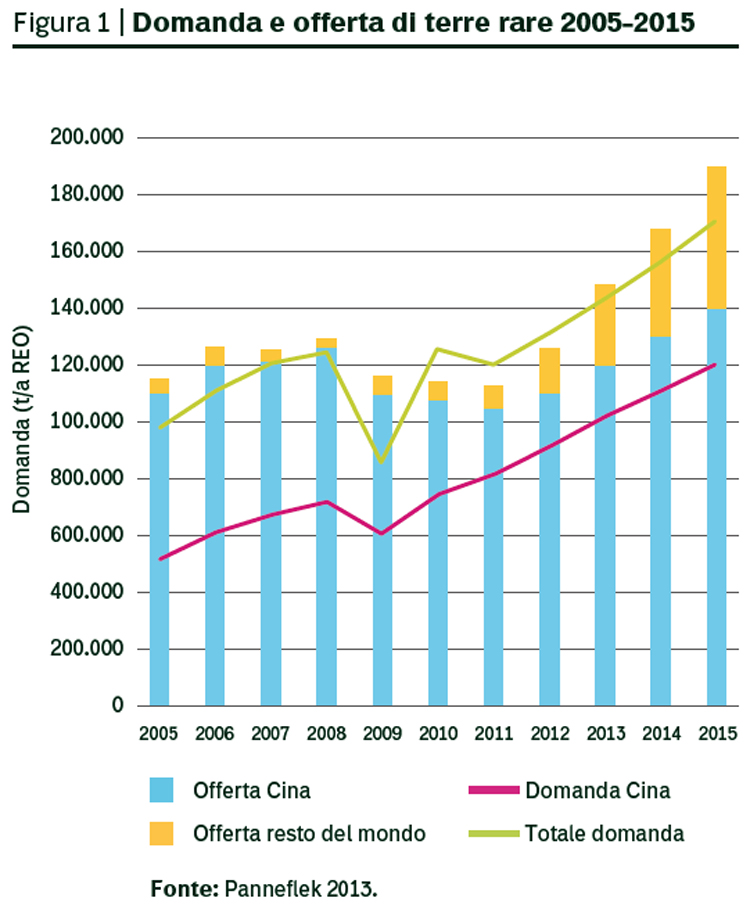

REE are considered such due to their essential function as the vitamins of modern industry. Over the past ten years, demand has tripled, reaching 125,000 tonnes in 2015. The USA, Japan, Korea, Russia and several EU countries are the principal importers while China is the main supplier, with almost 95% of global production, as well as the greatest consumer.

There are two ways of obtaining them: extraction and recycling. In theory, by recovering REE contained in different disused appliances, we could satisfy the whole of the Old Continent’s demand. That is why we use the term “urban mine” when we refer to the rare earth metal recovery process for recycling Waste of Electric and Electronic Equipment (WEEE). However this process is highly limited by its great cost.

Recycling: The Advantages

Still, let us begin with the numerous economic advantages of WEEE recycling: metal value recovery, REE extraction, transport and production cost containment, market presence growth and an improvement in corporate competitive capacity. There are other benefits connected to the reduction of mineral exploitation, industrial processing and WEEE disposal monitoring, as well as the improvement of conditions for the environment and the people who live in the vicinity of extraction sites. Last but not least, we have the reduction of land and air pollution.

Recycling REE from electronic waste is complex because, when several rare earths are present at the same time, separating them from each other is very difficult due to their chemical properties. What is more, reducing oxide in individual elements is extremely expensive. At the moment, REE recycling techniques are just beginning to develop and the whole industry is hampered by the nature of the product and the dispersion of the material.

Above all, the lack of a standard method affects the cost of recycling. This means that extracting Rare Earth Elements from WEEE is problematic and the process is long. Additionally, complex processing plants and great professionalism is needed.

That is why, in 2011, less than 1% Rare Earth Elements were recycled from WEEE (EPOW, “European Pathway to Zero Waste Report”, March 2011, http://tinyurl.com/hz4hyoa).

Recovering magnet powder is even more complex. According to a study by the Norwegian University of Science and Technology (Bristøl, 2012), there are few Rare Earth Elements in the material. Together, the four rare earth element oxides (neodymium oxide, yttrium oxide, lanthanum oxide and holmium oxide) totalled, on average, 0.311% of the magnets in the sample examined. This clearly indicates that their recovery is not yet economically advantageous. Although, in the future, perhaps thanks to a higher WEEE supply rate and improved recycling and magnet separation techniques, REE recovery could become more economically advantageous, the situation is quite the opposite for the moment.

The lack of development in recycling techniques depends on the low returns, high costs and the lack of WEEE available. If we do not identify alternative methods, these factors will continue to represent the most significant obstacle to economically-advantageous recycling.

Those working with rare earth elements

Despite the fact that a number of research projects into the extraction of rare earth elements have been active for years, an economically-advantageous protocol has yet to be identified. Italian and European researchers are working towards this objective in order to identify efficient REE separation processes.

For example, large companies such as Osramag (Germany), Solvay Group (France) and the Aerc Recycling Solutions and Global Tungsten & Powders (USA) partnership are conducting projects concerning fluorescent bulb recovery.

Many efforts are being made regarding research into processes for neodymium and dysprosium recovery from permanent magnets. The wide use of magnets in applications such as computer memories, compressors, loudspeakers, hybrid and electric engines, as well as wind turbines, makes this research sector strategic. Projects are currently underway in the Ames Laboratory (USA), Dowa Metals & Mining (USA), Mitsubishi (Japan) and Hitachi (Japan).

Experimental research projects underway in Europe are described in the document “Recovery of Rare Earths from Electronic Wastes: An Opportunity for High-Tech SMEs.”

“Recovery of Rare Earths from Electronic Wastes: An Opportunity for High-Tech SMEs”, tinyurl.com/oqc7qad

REE Deposits

A 2015 study evaluating the distribution of Rare Earth Elements in terms of type of use highlighted their presence mainly in the specialist sector of catalysts (60%), followed by the sectors connected to metallurgic and alloy applications (10%), and permanent magnets and glass polishing (10%). All the other areas share the remaining 10%.

Magnets containing Rare Earth Elements (neodymium-iron-boron and samarium-cobalt) are the strongest and most used. They are used in personal computer hard disks, loudspeakers, headlights, wind turbines and hybrid electric engines. The magnets in the generators associated with wind turbines contain high quantities of Rare Earth Elements, while neodymium is an element in personal computer and tablet hard disks.

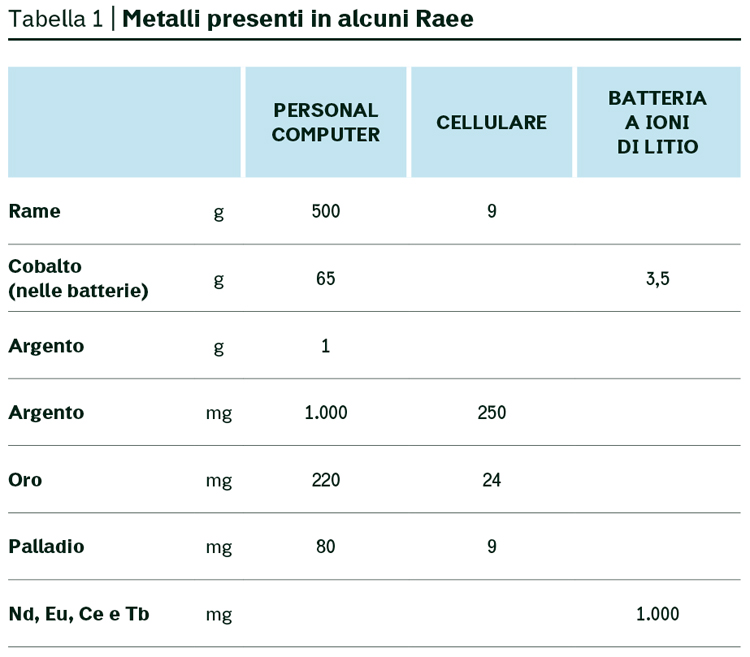

WEEE contain iron, steel, aluminium, glass, lead, mercury and special and precious metals, including gold, silver, platinum, palladium, rhodium, ruthenium, copper and cobalt.

According to the US Environmental Protection Agency, by recycling a million mobile telephones we could recover 22.65 kilos of gold, 249.15 kilos of silver, 9.06 kilos of palladium and 9,060 kilos of copper.

Batteries and circuit boards are the technological waste with the most interesting rare earth element content which includes gold, silver, copper, platinum and tantalum. Cerium and europium are to be found in computer, smartphone and television liquid-crystal displays. Strong permanent magnets made from alloys of neodymium-iron and boron installed in computers and loudspeakers contain praseodymium, neodymium, samarium with iron, terbium and dysprosium with iron. In addition, magnet powder contains yttrium, lanthanum and holmium.

The Market Trend Over the Past 15 Years

In order to guarantee REE supplies, technological-sector companies are willing to purchase at a higher price than current rates, so the market is extremely dynamic. Due to global scarcity and the fact that supply is largely controlled by China, REE prices change continuously.

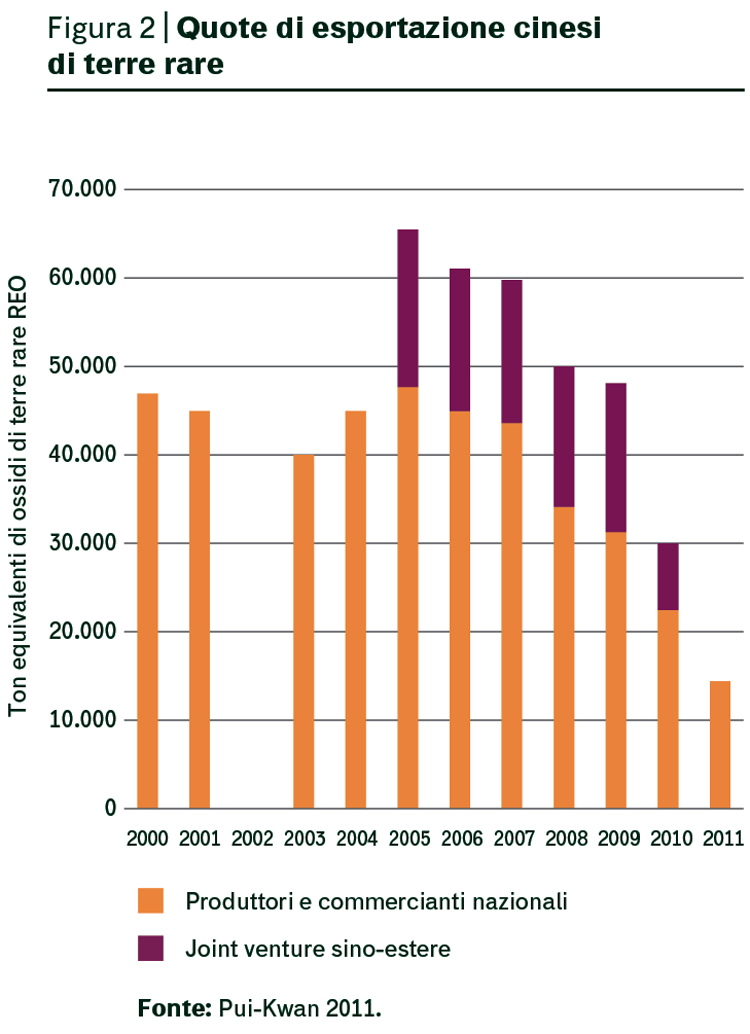

China’s privileged position in the REE market is the result of a specific policy. It is no coincidence that, in 1992, Chinese leader Deng Xiaoping, already an important member of the People’s Republic of China’s political system and a pioneer of economic reform, declared: “There is oil in the Middle East; there is rare earth in China.” Since then, Chinese policy has aimed to stabilise prices and set a production cap, support the national sector by reducing export and hindering foreign company access, conserve natural resources by imposing sustainable-production rules, develop the sector also through joint-ventures with foreign companies.

Between 2001 and 2009, due to growing demand from companies, prices – according to Argus Rare Earths, London Metal Exchange and InvestmentMine information sources, reorganised by Mineral Prices (mineralprices.com/default.aspx#rar data accessed 25 January 2016) – remained substantially stable. During the following three-year period, the market’s monopolistic conditions caused world prices to increase significantly and Chinese prices to decrease in parallel. The increase in prices outside of China stimulated the creation of new projects concerning foreign companies’ exploitation of alternative resources to Rare Earth Elements, thus determining increased supply and a further price drop.

Between 2005 and 2012, the average quantity of REE oxides supplied totalled 120,000 tonnes. In 2012, the Rest of the World (RoW) supply increased, contributing to an increase in the total quantity of REE. In this period, the demand, mostly from China, had a constant tendency to increase (figure 1)

In order to consolidate the national sector and apply environmental-protection standards, China fixed export prices.

This decision created two REE markets: the first within China and the second in the RoW. Chinese exportation represented the most part of RoW supply. This can be demonstrated by the price peak that occurred in 2011 and the decrease in exportations (figure 2). This situation was also accentuated by contingent events. For example, according to some experts, in 2010, reduced exportations were also conditioned by the collision between a Chinese trawler and two Japanese coastguard patrol boats in the vicinity of the Senkaku islands, in waters disputed by the two countries. The Chinese vessel’s captain was arrested by the Japanese authorities for having “invaded” their territorial waters. The occurrence set off a wave of nationalism in China and led to the consequent block on REE exportation into Japan.

Starting from the first half of 2011, prices dropped by 50-70%, even reaching 90%. The market was so shocked that a restructuring of the world REE industry came about. In 2012, Moycorp (Colorado) sold REE concentrates at an average price of 36 dollars a kilo, in comparison to 82 dollars in 2011.

In 2014, the prices of most REE compounds decreased due to excess supply. REE consumption in the fluorescent material industry dropped because of the increase in LED lighting use.

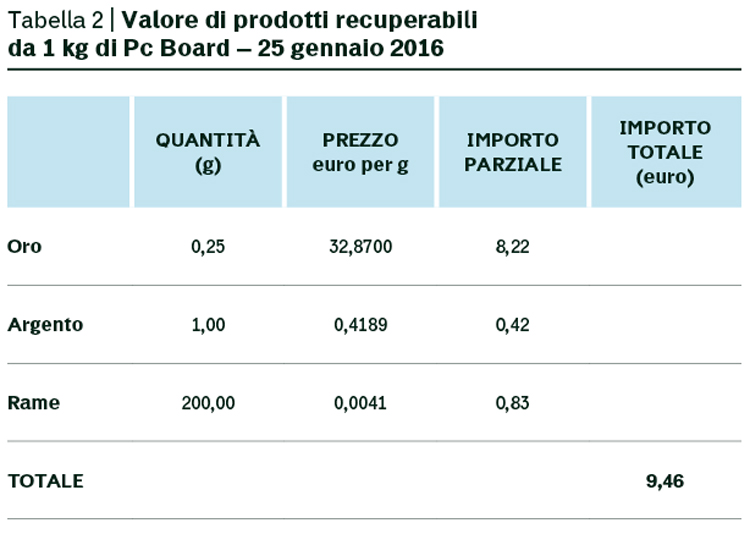

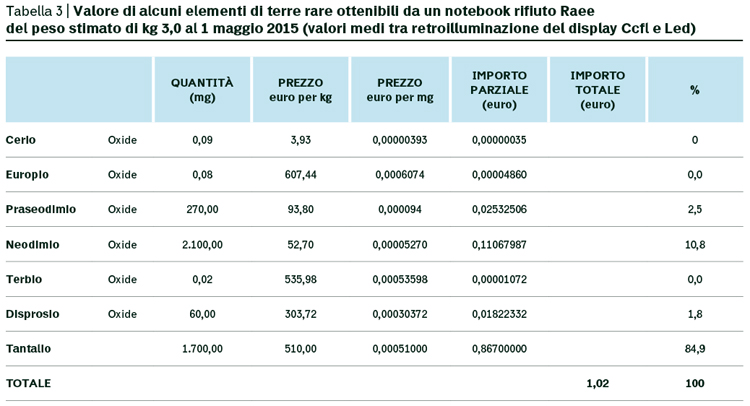

The quantity of metals in WEEE depends on the type and period of construction while their monetary value is connected to the price trend of the individual metal (table 1 and 2). Between May and December 2015, due to the reduction in REE oxide prices, the total estimated value of REE which can be recovered from a WEEE notebook, weighing an estimated 3 kg, dropped by 52.9% shifting from 1.02 to 0.48 euros (table 3).

|

|

|

|

|

Price sources:

|

|

|

Price sources: mineralprices.com/default.aspx#rar 1st May 2015 euro/kg

|

European Pathway to Zero Waste – EPOW Report, March 2011, tinyurl.com/hz4hyoa

Bibliography

-

Bristøl L. M. L., Characterization and recovery of rare earth elements from electronic scrap, Norwegian University of Science and Technology, Department of Materials Science and Engineering, 2012.

-

Panneflek E., Why Investing In Rare Earth Elements?, www.pgm-blog.com/why-investing-in-rare-earth-elements, 2013.

-

Ungaro A. R., “Il mercato delle terre rare: aspetti politici e finanziari,” IAI documents, International Affairs Institute, 13/4 July 2013; www.files.ethz.ch/isn/178533/iai1304.pdf

Top image: gems design by Stephanie Wauters - The Noun Project