A Country aspiring to have a circulating car fleet no longer powered by fossil fuels by 2030. A national chemical industry that – by the same year – aims at becoming totally oil free. A plant system for the production of cellulose and paper that is already powered by organic sources. A network of plants for the production of cellulose and paper, 96% already powered by bio-sources. It is easy to understand why Sweden “is blazing a trail for a renewable future,” as proudly claims the Swedish Trade and Invest Council in its document Bioeconomy in Sweden. The Scandinavian Country, which closed 2016 with an economy growth of 3.7% and that is ranking sixth in the world for competitiveness according to the Global Competitiveness Index (GCI) 2016-2017, “aspires to become a leading player in the change towards a society with a wider use of renewable materials.”

A legitimate ambition, if we consider its strengths: the vast availability of biomass, strong support to research, development and innovation, great environmental awareness of population, the presence of a technologically-advanced industry and of a vast number of multinational corporations in various sectors – such as Tetrapak, Ikea, Volvo, Ericsson, H&M, SCA and Sandvik – which deem the development of new materials crucial for their business.

According to Growth Analysis, a governmental agency controlled by the Ministry of Enterprise and Innovation, in 2014 the Swedish bioeconomy accounted for 7.1% of total added value (two thirds of which deriving from the forestry sector), with 350,000 employees and 22.9% of total exports of goods.

A Strategy Focusing on Renewable Resources

Replacing fossil fuels with renewables is one of the pillars of Swedish strategy on the bioeconomy commissioned in September 2011 by the Stockholm’s government at the National Council for sustainable research and development (FORMAS), supported by the Agency for innovation (VINNOVA) and the national Energy Agency. Obviously, wood has the lion’s share. “Sweden’s natural geographic conditions – as it reads on the Swedish Research and Innovation Strategy for a Bio-based Economy – have always meant that products derived from agriculture and forests, as well as from fishing, have been of great importance for social development.”

The other three pillars are the development of smarter products and a smarter use of raw materials (including by-products and recycling); the change of consumer and attitude habits; the implementation of new policies eschewing conflicting objectives while creating a system optimization.

The challenge launched by the government is to find solutions improving both commercial and environmental benefits, while conserving and augmenting biodiversity and reducing, amongst other things, the use of pesticides and antibiotics.

The Forestry Sector

The Forestry Sector

The forestry sector is of great importance, boasting a huge raw material heritage. Since the end of the 19th century the Swedish industry of cellulose and paper has increasingly led the world markets. According to the Swedish Forest Agency, the average value of a cubic metre of forests is about SEK300. Multiplied by the total value of 3 billion cubic metres, it comes to SEK900 billion, or about €90 billion. It is about one fifth of Sweden’s total GDP. The transition phase of the sector, caused mainly by the decline of the demand of paper for newspapers and offices, pushed companies to search for new application fields. Thus new research centres cropped up such as SKOGFORSK (Forestry Research Institute of Sweden) dealing with applied research in order to close the gap with the industry. Or the Forest Machinery Cluster, facilitating cooperation amongst researchers, forestry enterprises and the industry and that allowed Sweden to become a leader in the world market of forest machinery.

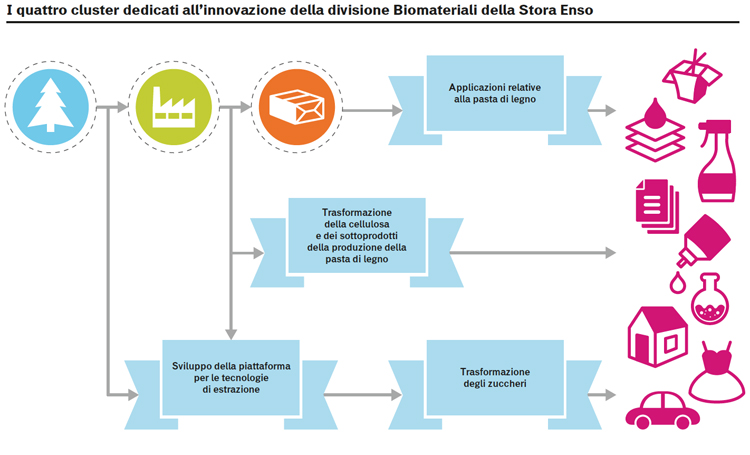

An iconic example of reconversion of the forestry industry to the bioeconomy is that of Stora Enso, the paper and cellulose giant that has created a Biomaterials Department aiming at extracting hemicellulose, sugars and lignin from production waste in order to obtain products with a higher added value. In 2015, in Stockholm, an Innovation Centre has been inaugurated hosting research, application, business development and strategic marketing.

“Another important step forward towards Stora Enso’s transformation into a company of renewable materials,” as Karl-Henrik Sundström – the Scandinavian company’s CEO – put it. “We are convinced that our access to biomass, in combination with the competence of the forestry sector the world over, will bring advantages to our clients in the future, in new and innovative ways. Our aim is to develop a competitive supply, serving clients in a variety of industries and markets, while adding value to our cellulose flows.”

In such direction, the Sundström-led company invested €12 million last January in order to build a new production line for biocomposite granules in the Hylte plant in Sweden. The production is expected to start in the first quarter of 2018, with an annual capacity of about 15,000 tonnes.

The biocomposite granules are a mix of wood fibres, polymers and additives which are used as raw materials for injection moulding and extrusion of products traditionally manufactured with plastics. The material can be used in a vast array of products, from consumer goods (dish or pot brushes etc.) to industrial applications such as pallets or load-bearing structures reinforced with glass fibres.

Big Corporations: Producers and Brandowners

The chemical industry too looks to the sector of biomaterials, led by Perstorp Group, allocating 85% of its expenditure in Research & Development to environmental sustainability. A world leader in the production of polycaprolactone polymer (PCL), traded under the Capa trademark, over the last few years the Swedish group is investing in the development of new bioplastics: in 2014, a new pilot plant has started in Warrington (UK) and in 2015 a research and development lab in the small town of Perstorp has become operational. “We are improving our competitiveness in bioplastic – Linda Zellner, in charge of the Perstorp’s Bioplastics Projects, informs us – where we are going to be at the forefront in the development of new products, since Capa Thermoplastics adds significant value to the performance of biopolymers and end-of-life solutions.”

In particular, according to Perstorp, Capa is certified as compostable and 100% biodegradable within 45 days, it is hydrolitically stable and thus usable for a number of applications and is compatible with biopolymers such as PHA and PLA. Today the company focuses on three main growth segments of bioplastics: paper lining, bags, films and packaging.

In the field of packaging and food packaging, Sweden can boast one the world’s top players: Tetra Pak. The company founded in 1951 in Lund has already marketed a Tetra Rex, a package 100% made from a renewable source, exclusively produced with paper and polymers derived from vegetable sources.

Just as the Forest Stewardship Council (FSC) certified paper, the polymers can be traced back to their origin and this allowed the container to receive the highest level of bio-based certification by Vinçotte – a Belgian accredited inspection and certification organisation recognized worldwide. The vegetable-based polymers used by Tetra Pak are not made in Sweden, but they are manufactured by Braskem, a Brasilian biochemical company deriving its raw materials from sugar cane farmed on degraded soils.

Tetra Pak cartons are already used by the dairy giants such as Finnish Valio and Danish Arla to market milk-based drinks. This is just a first step, because Tetra Pak is currently in talks with a number of companies in various parts of the world to launch the container. “We estimate – the Swedish company states – that considering the product’s whole life cycle, the choice of biopolyethelene compared to fossil-based polyethelene will reduce the carbon footprint by 20-35%.”

From packaging to furniture, an all Scandinavian partnership between Ikea and Finnish Neste. The Espoo-based company will provide the Swedish furniture giant renewable and biobased plastic materials. Such collaboration combines Ikea’s commitment to reducing its own reliance on virgin fossil materials and Neste’s competence in the development of new products from renewable sources, as residues or waste. “We are very pleased – asserted Tuomas Hyyryläinen, Senior Vice President, Strategy and New Enterprises in Neste – to create a partnership with Ikea. Ikea’s commitment to starting a change in the industry is an extremely important step in the redefinition of the way products will be manufactured and of how raw materials will be used in the near future.”

“Ikea is going to contribute to a transformation of the industry and the development of plastic materials produced from recycled or renewable sources. In line with our objectives, we are moving away from fossil-based plastic materials towards those produced from more sustainable renewable sources, such as waste and residues, not using palm oil and by-products as raw materials,” added Lena Pripp-Kovac, Ikea’s Sustainability Manager.

The theme of sustainability is also a fundamental point for Hennes&Mauritz AB, another Swedish multinational company, commonly known as H&M, the clothing giant with 116,000 employees scattered around the world, since 2015 a partner for the Ellen MacArthur Foundation for the circular economy. “At H&M we have a long-term vision to become 100% circular, using for instance recycled materials or from other sustainable sources,” states Felicia Reuterswärd, H&M Sustainability Manager.

The theme of sustainability is also a fundamental point for Hennes&Mauritz AB, another Swedish multinational company, commonly known as H&M, the clothing giant with 116,000 employees scattered around the world, since 2015 a partner for the Ellen MacArthur Foundation for the circular economy. “At H&M we have a long-term vision to become 100% circular, using for instance recycled materials or from other sustainable sources,” states Felicia Reuterswärd, H&M Sustainability Manager.

One of the most promising research spheres, in which Stora Enso itself is heavily investing, is the use of wood as raw material to produce textile fibres. “The world is using more and more fabrics and there is a growing demand for sustainable materials, such as wood fibres,” affirms Weronika Rehnby, in charge of sustainability for TEKO, Swedish Textile and Clothing Industries. “We are searching for renewable and reusable materials, and in this respect sustainably-produced viscose is an excellent alternative to cotton.”

High-Quality Research

Rise Bioeconomy, one of six divisions of RISE (Swedish Institute for Research), co-managed by the Swedish government is leading the Swedish transition. In 2016 Inventia AB, the company of active research in the sector of cellulose, paper and packaging also joined the team. Already in 2011, in Stockholm, it had opened the first pilot plant in the world for the production of nanocellulose (a new entirely renewable, light and sturdy material that can be used in many sectors. In the production of paper and cardboard it can act as a reinforcing agent, in the lining for food packaging it can be used as protective material against oxygen, water vapour, fat and oil).

The new 2018-2020 research programme for research on the bioeconomy is the work of RISE. Such initiative is conceived as an accelerator in its own right based on the research for the Swedish bioindustrial transformation.

“The programme – RISE say – offers a unique company network, a meeting point for debating and conceiving binding ideas.” The research topics stem from industrial needs, global trends and market drivers and will be constantly reviewed, refined and classified throughout the programme. The target is the production of new biomaterials, but also bioenergy, bio-based chemical product and biofuels for transport, that “nowadays – the RISE people claim – are at the top of the political agenda, as a way to reduce fossil-derived CO2 emissions while increasing the use of renewable materials with the use of local resources.”

Within the framework of policies supporting research and development on biochemicals, “BioInnovation” is also worth mentioning, which with a yearly budget of €10 million it involves 60 players of the Swedish bioeconomy, one half of which are companies and the other is made of research organizations. Its target is to develop innovative and high-yielding materials, as well as services and products based on renewable raw materials in four areas: chemical products and energy, construction and design, materials and new uses.

Universities do not just stand by: research on the use of biomass is carried out in over 30 top universities’ departments and centres including Royal University of Technology (KTH), Chalmers University of Technology, Lund University and Swedish University of Agricultural Sciences. Their work created Gobigas, the first plant in the world for the continuous production of high-quality biomethane from biomass through gasification. The relation between the industry and academia underpins the growth of the bioeconomy, according to Growth Analysis. “Encouraging exchange and collaboration amongst companies, universities, research institutes and other stakeholders in the fields of the bioeconomy and in other sectors where new markets can be created is a priority measure,” equal to the creation of a market through a system of green public procurement.

Bioeconomy in Sweden, www.business-sweden.se/en/Invest/inspiration/publications/bioeconomy-in-sweden

Swedish Research and Innovation Strategy for a Bio-based Economy, www.formas.se/PageFiles/5074/Strategy_Biobased_Ekonomy_hela.pdf

RISE, www.ri.se/en

Interview with Andreas Birmoser, Stora Enso

by M. B.

From Wood to Biomaterials

“Stora Enso will continue to expand its biomaterials focus while remaining committed to its current customers in pulp, paper, cardboard and wood products. Wood is our most important raw material and we know more can be extracted from wood and other non-food competing biomass to create a range of high-performance, bio-based products.” To say it – in this exclusive interview with Renewable Matter – is Andreas Birmoser, SVP Strategy and Business Development at Stora Enso Biomaterials. With the manager of the Scandinavian pulp and paper company we talk about its trasformation into a renewable materials company, the bioeconomy and the circolar economy.

Stora Enso is increasingly a renewable materials company. What are your next steps to replace fossil-based products?

“Indeed, Stora Enso is transforming into a renewable materials company. We are exploring new ways to efficiently use wood and other non-food competing feedstocks to meet customer and consumer needs with alternatives to fossil-based materials. Paper, cardboard, commodity and specialised pulp are our largest market segments. However, with paper use declining, the company is diversifying its offer and developing new products. New technologies are enabling Stora Enso to extract hemicellulose, sugars and lignin from biomass and use these fractions more efficiently for new applications.

“The Stora Enso Biomaterials division was set up in 2012 to focus on innovations in bio-based materials and further develop our market pulp business. Through our four innovation clusters, the Biomaterials division is working to transform non-food-competing, non-GMO, second-generation biomass into solutions for its customers. 11 years ago, paper was 70% of Stora Enso’s business, while today it only represents 31%. Biomaterials account for 14% of total sales.

“One of the main focus areas for the Stora Enso Biomaterials division is the development of its extraction technology platform, based on biomass. Technology was acquired from Virdia in 2014 and is being developed at a plant in Danville, Virginia. Later this year, a demonstration and market development plant in Raceland, Virginia will come online. At Raceland, xylose will be produced from sugarcane bagasse, which can be transformed into xylitol and demonstrate the acquired extraction technology.

“Lignin extraction has also been a recent focus. In 2013, we began commercialising dried Kraft lignin, having invested €32 million in new lignin separation technology at our Sunila Mill in Finland. Using LignoBoostTM technology, Sunila has been producing lignin since 2015.

“Lignin is an ideal candidate for producing new materials and intermediates. Refined lignin can be a replacement for oil-based phenolic materials which are used in resins for adhesives e.g. in plywood, veneer applications, laminates and insulation material. In the future, Stora Enso is looking into the possibility of developing lignin into carbon fibre applications.”

Today it seems that the bioeconomy paradigm has been surpassed by the circular economy, although the latter is in many ways still fossil-based. How could your company fully integrate these two paradigms?

“The circular economy is rapidly gaining momentum and awareness as a concept. Much like the bioeconomy, it has the potential to create new jobs while reducing dependence on energy and primary materials. Stora Enso sees the bioeconomy and circular economy as complementary concepts – the bioeconomy’s strong research and innovation dimension can contribute to the circular economy transition while also reducing dependence on fossil fuels and reducing carbon emissions. Bio-based products have a more balanced carbon cycle and a shift to biorefineries, which use renewable resources, will make the circular economy more sustainable.

“The focus of Stora Enso Biomaterials’ business platform, based on biomass, is to efficiently extract different fractions from wood and other biomass, leading to cellulose fibres, C5 sugars, C6 sugars and lignin. Once the technology is demonstrated, this biorefining model could be integrated in existing pulp mills.

“Recently, Stora Enso EVP Per Lyrvall was appointed one of 25 representatives for the Swedish government cooperation programme ‘Circular and Biobased Economy,’ which aims to grow the bioeconomy and promote circular solutions.”

Stora Enso, whose packaging users around the globe include Nestlé, Starbucks and Barilla, now aims to become market leader in China on high-end food and drink packaging. Is there now a demand from consumers for new forms of more environmentally-sustainable packaging?

“Demand from consumers – and brands – for more environmentally-friendly packaging has certainly been increasing over the last few years. This is why we are developing extraction and separation technologies, to get the most out of non-food-competing biomass and reduce costs. However, an issue which continues to limit uptake of bio-based packaging is a lack of awareness and misunderstanding of what bio-based means, as well as what the difference between bio-based and biodegradable is. It is vital for businesses to acknowledge this and educate customers and brands on the sustainability and performance benefits of bio-based products.”

Do you use a specific labelling system for biobased products?

“All of our wood is 100% traceable to its forest of origin. Stora Enso promotes credible forest certification and works actively with stakeholders to promote sustainable forest management. Our wood comes from forests in the Northern hemisphere and eucalyptus plantations worldwide.

“Currently, Stora Enso uses existing ecolabels (such as the Nordic Swan and the EU ‘Flower’) for its products.”

How relevant are the policies implemented by Finnish and Swedish governments in supporting your R&D in the bioeconomy? What are the strengths and weaknesses of the bioeconomy in the Nordic countries from your point of view?

“Finland has a bioeconomy strategy which strongly supports Stora Enso’s goal to become a truly renewable materials company. The current governments’ key development areas, ‘Bioeconomy and clean solutions’ are also well in line with Stora Enso’s transformation.

“The Swedish government is working on strategies to support production based on renewable raw materials. Their environment and climate strategy is being updated and a national forest strategy, which will support bioeconomy development and therefore Stora Enso’s business, is also being developed.”

In a nutshell, is your future fully bio-based?

“Stora Enso will continue to expand its biomaterials focus while remaining committed to its current customers in pulp, paper, cardboard and wood products. Wood is our most important raw material and we know more can be extracted from wood and other non-food competing biomass to create a range of high-performance, bio-based products.”

Stora Enso, www.storaenso.com