The transition of the classical chemical sector based on fossil feedstock such as coal, oil and gas, to greener chemistries, based on renewable feedstock, holds an enticing perspective for CO2 reduction, new functional materials, new value chains, new knowledge and open innovation, independent feedstock position, as well as offering chances for rural and regional economic structural reinforcement. In addition it leads to innovative green chemistry development and novel applicatioans coupled with scaling up of SME companies, creating jobs and added value. And last but not least a growing biobased economy is positive for related sectors such as agricultural, logistics, energy and process industry. Many of these use first generation carbohydrate crops as feedstock, such as sugar cane, sugar beet and starch from potatoes and wheat. Alternative technologies that alleviate competition with food production are highly sought after. This brings us to Lignocellulose as biomass feedstock for the biorefineries of the present and the future.

However, the journey to full scale for lignocellulosic feedstock has not been without major challenges and hurdles such as with: Abengoa (bankrupt), POET/DSM (redesigned), Dupont (stopped), Betarenwables (continue as ENI). On a positive note, Clariant has joined the list of large scale cellulosic ethanol producers via their Sunliquid technology with a first large project in Eastern Europe (Romania) using wheat straw as feedstock.

Also engaging in the search for other renewable feedstocks and fast track technologies for making ethanol, such as food waste (St1), MSW (Enerkem, Fulcrum), waste syngas (Lanzatech), household & grocery biowaste (St1), sawdust (St1/SEKAB). Therefore, the trend towards waste feedstock other than lignocellulose for biofuels and renewable chemicals beyond ethanol is evident.

Syngas, either derived from biomass waste gasification, derived from MSW, or derived as waste syngas from the steel industry is established as an important platform. The platform enables to compete in the bulk and commodity chemical markets via drop-ins. Recently, a renewed focus on higher end performance chemicals and materials with added functionality has been apparent. Good examples include FDCA and the corresponding PEF and PTF polymers; novel PHA biodegradable copolymers with elastomeric properties; Isosorbide, and its derived plasticizers, (co)polyesters and (co)polycarbonates; Levulinic acid based solvents; and Itaconic acid for biosurfactants.

The Need for De-risking

In the Biobased Delta cluster the project office has developed an “eight pack” to assess the required de-risking for large initiatives, so as to obtain robust and bankable projects. The eight pack consists of: feedstock, technology, business case, market, supply chain, operator or value chain manager, policy and location as vital elements of an in-depth analysis (see Figure 1).

All eight need to be addressed in an integrated approach, although there are some unique features.

New and Alternative Feedstock

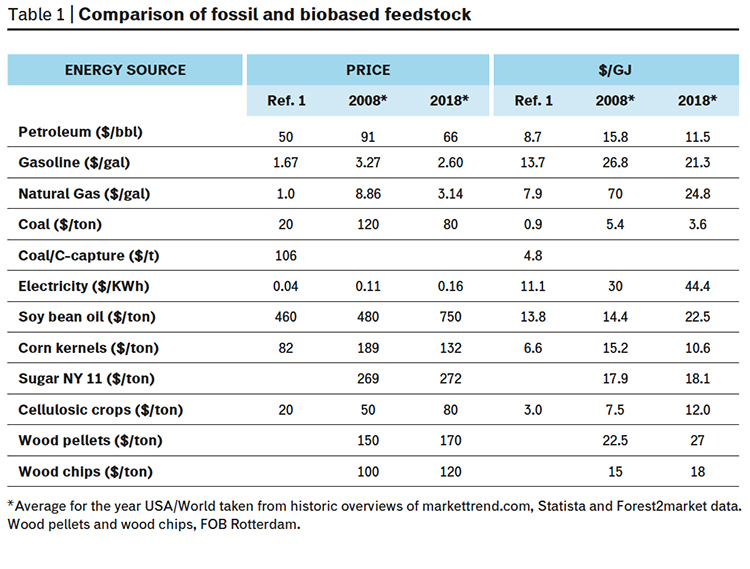

In all cases biobased feedstock is more expensive than coal on a $/GJ basis (Table 1).

Low cost biobased feedstock such as corn kernels and lignocelulosic crops have a profound regional characteristic with a high collection and transportation cost outside the productive region. This is addressed by including raw sugar, as well as wood pellets and chips that are transported over the world in bulk quantities (see Table 1).

With proper selection of the target molecules biomass can be a viable alternate feedstock for chemicals and materials in a cost scenario where oil is in the range of 60-80 $/bbl and biomass remains in the 2008-2018 bracket. Next to price of the feedstock, other feedstock topics need to be addressed in order to be accepted by the chemical industry as a qualified source: volume, availability, quality, consistency, sustainability, certification, storage.

A Safe Supply Chain

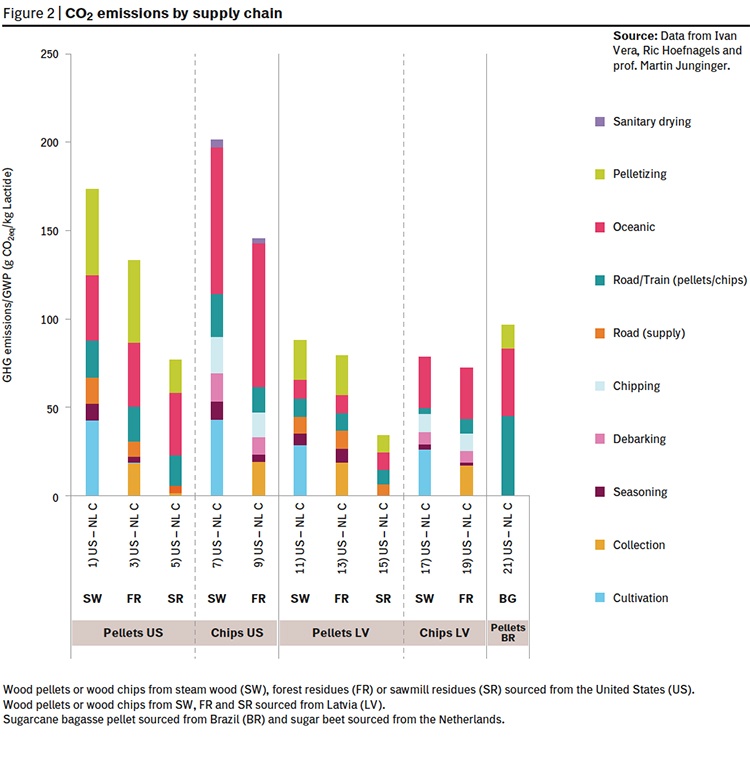

A chemical company will only embark on a project if the feedstock supply chain is known, understood and managed by trusted parties. Relevant questions include: is there an established supply chain; are there other sources available, or is the biomass single sourced; can the biomass be transported over distance in bulk (density, moisture); can long term supply contracts be negotiated for 10-15 years? CO2 impacts have also been investigated by the Copernicus Institute of the University of Utrecht on request of Biobased Delta (Figure 2).

Operator or Value Chain Manager

The new value chains are realised through biorefineries. Depending on the main product, the biorefinery system can be named as energy-driven biorefinery or product-driven biorefinery (ref 2). Just as fossil feedstock refineries, the biorefineries need to valorise the complete biomass input with high overall yield and maximum value. Hybrid models are being developed such as Redefinery by Biobased Delta.

The biorefinery is the place where agro meets chemistry and knowledge of both worlds is required. Pulp & paper companies have fulfilled this role over the past centuries. In the emerging circular biobased economy, waste management companies will have an opportunity to establish themselves as operator and/or value chain manager of future biorefinery investments. Since the launch of their commercial-scale waste-to-biofuel facility in Edmonton, Enerkem has launched its first European project in the Biobased Delta region, with a consortium led by AkzoNobel, Air Liquide, and the Port of Rotterdam. Shell recently joined as off-taker for the biomethanol and co-investor in the project.

The Impact of Policy

Policy has a major impact on development, upscaling, investment and business. Significant subsidies incentivised companies to embark on 2G development and upscaling. When policy uses subsidies and incentives as instruments there is an inevitable distortion in the market. The example of biomass cascading might explain this nicely. It is part of the Dutch policy on biobased economy and aims to first create the highest possible value from the biomass, defined in the following order: health-food-feed-performance materials-commodity materials-fuels-heat-electricity. It is curious to see that the lowest applications are the ones that receive subsidy with highest biomass utilisation for energy as a result. In the new national climate agreement 2019 this will most likely be addressed. It is a necessary condition for biochemicals and biomaterials to have a level playing field with biofuels and bio-energy use.

Technology Needs for Green Chemistry

A number of technology needs of green chemistry for Lignocellulose are evident and include: complete conversion of the biomass and sugars; process control over formation of impurities that impact fermentation and (bio)catalyst efficiency; higher process efficiency via higher throughput; valorisation of hemicellulose beyond bioethanol valorisation of lignin beyond energy use; nutrients and water recycling are integrated for a better use of these resources and to close the cycle from a sustainability perspective.

New technology needs the development of green chemistry for lignocellulose to include:

1. First and foremost for the pre-treatment of the lignocellulosic biomass beyond existing processes such as Kraft, sulfonate, alkaline, steam explosion, and organosolv technology. Lower energy processes are the main driver.

2. Lower cellulase enzyme costs. On-site enzyme production is the way forward for two reasons: lower costs and the possibility to tailor the enzymes to specific raw materials and processes by cutting out the need for costly concentration, formulation, and transport.

3. No cellulase enzyme costs. In the Netherlands two new technologies are being scaled-up to address this need: Dawn technology by Avantium and BIOeCon G2 technology by Cellicon. Completely closing the loop on the used HCL and ZnCl2.nH2O is a technology need from a cost, quality and environment point of view.

4. Better fermentation process economics. Fermentation remains challenging as a manufacturing technology for low-priced molecules but is getting good traction for higher value products.

5. Lower energy input technology in the dewatering of wet biomass. This need is surfaced within Biobased Delta by the Biovoice Challenge Program organised by the regional development agency REWIN and the Green Chemistry Campus. They have collected technology and innovation needs from large companies (challengers) to be addressed by innovative SME and technology companies.

6. Other technology challenges in Biovoice include: opportunities for novel green chemistry starting from available high purity fructose (F99), new routes to non-food markets for valorisation of pectin (fragments), galacturonic acid derivatives and arabinose. And last but not least how can we design tuneable biodegradability into bioplastics?

How Will the Market Evolve?

According to Inkwood the global biofuels & biodiesel market is estimated to grow by approximately 5.48% CAGR during the years 2018-2026. He gives a number of reasons for the rising demand, of which increasing availability of feedstock and government regulations supporting the adoption of bio-based fuel alternatives are the most important.

Nova Institute recently published an update of their bio-building blocks and materials outlook for 2017-2022 after stronger growth between 2011 and 2014, we see less growth with a CAGR of 3 to 4% from 2014 to 2017. According to the latest forecasts, this trend will continue until 2022 and is more or less in line with expected growth in the petrochemical polymers and overall market.

Where and by Whom?

Location factors, such as cost for feedstock, energy and utilities, logistics, personnel, materials, land, housing are key. Other important factors are availability of schooled labour, safety in the region, weather and natural events, living environment, work habits, union impact and strikes, industry track record. Separate from this more or less standard protocol, for the Biobased sector there is the fundamental question about business model: close to feedstock, close to market or local for local? There is no standard, but it appears that commodities tend to be best produced close to feedstock with bulk shipment to the global markets, specialty products tend to be best produced close to market with goods shipped breakbulk to consumers. The unique model is the local for local in the Biobased economy with regional lignocellulosic feedstock conversion into local performance chemicals.

A Unifying Business Case

In the business case all the listed elements come together and it should be much more than a technical-economic analysis (TEA). Drop-in chemicals and materials will remain a difficult proposition for lignocellulose because of cost and the apparent lack of a green premium for renewable solutions. Bio-building blocks that bring new functionalities are receiving more interest. The local for local model deserves more attention for local performance products like glycolic acid, its glycolide, its polymer and copolymer with lactide and other comonomers for use in regional biomedicial and skin markets. Benign solvents for paints and coatings are another example.

Green Chemistry’s Future

The needs of green chemistry in Lignocellulose concern four main challenges: more bankable business cases, more consistent support from governments, more financing for scale-up, and commercialisation with bigger impact. This will require a variety of factors including:

- 100 % secured sustainable feedstock with multiple sources and 10-15 year contracts

- Long term off-take agreements with index based pricing

- EPC contract guarantee for cost and plant performance

- Use of realistic start-up scenarios

- An investment grade technology insurance wrap that guarantees plant performance

- Robust piloting and demonstration of integrated unit operations that result in stable operation windows and operational excellence

- New business models with valorisation of local biomass and renewables on a scale as small as possible and as big as needed

- Roll out of new technologies such as those listed in the new technologies paragraph.

Biobased Delta, https://biobaseddelta.com

Biobased Circular Business Platform, www.biobasedeconomy.nl/bcb

Green Chemistry Campus, www.greenchemistrycampus.com

Top image: EM80/Pixabay

References

- L.R. Lynd et al., Current Opinon in Biotechnology, 2017, 45, 202-211

- Celina K. Yamakawa, Fen Qin , Solange I. Mussatto, “Advances and opportunities in biomass conversion technologies and biorefineries for the development of a bio-based economy”, Biomass and Bioenergy 119 (2018) 54-60

- Inkwood Research, Global Biofuels & Biodiesel Market Forecast 2018-2026; www.inkwoodresearch.com/reports/biofuels-and-biodiesel-market

- Raj Chinthapalli, Michael Carus, Wolfgang Baltus, Doris de Guzman, Harald Käb, Achim Raschka, Jan Ravenstijn, Bio-based Building Blocks and Polymers – Global Capacities and Trends 2017-2022, Nova-Institute Maggio 2018; download short version http://bio-based.eu/download/?did= 136226&file=0