|

|

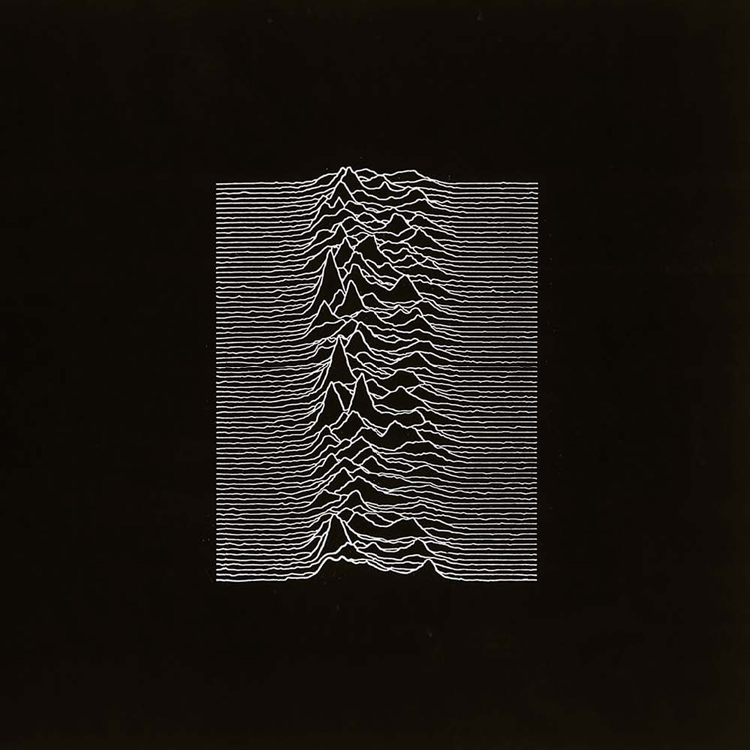

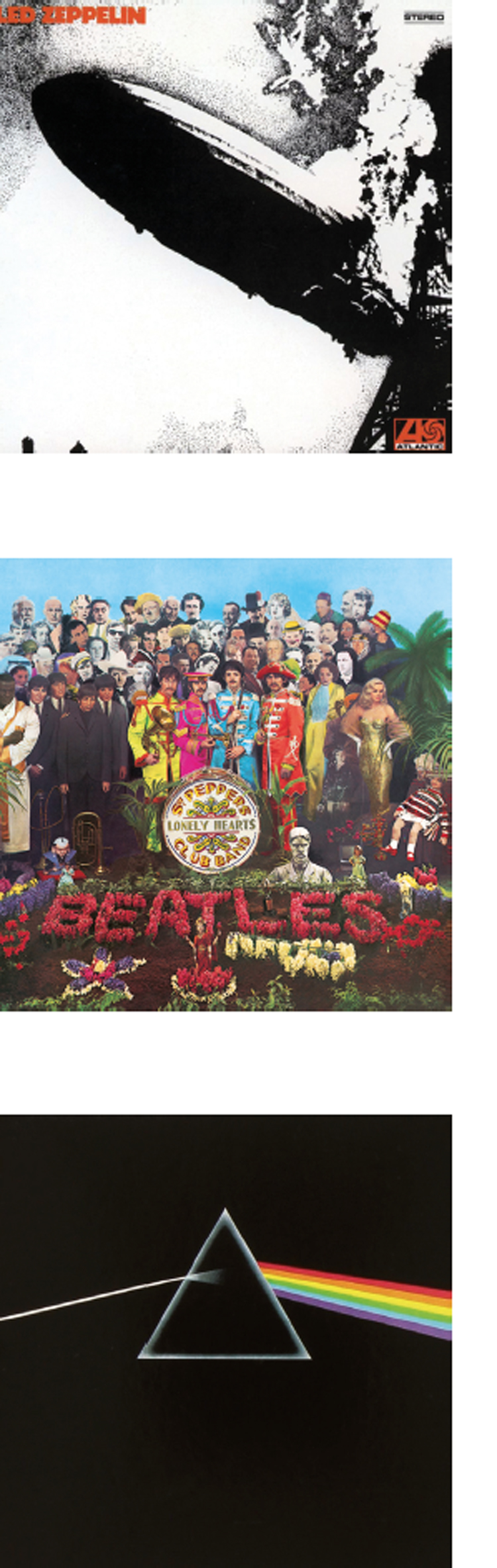

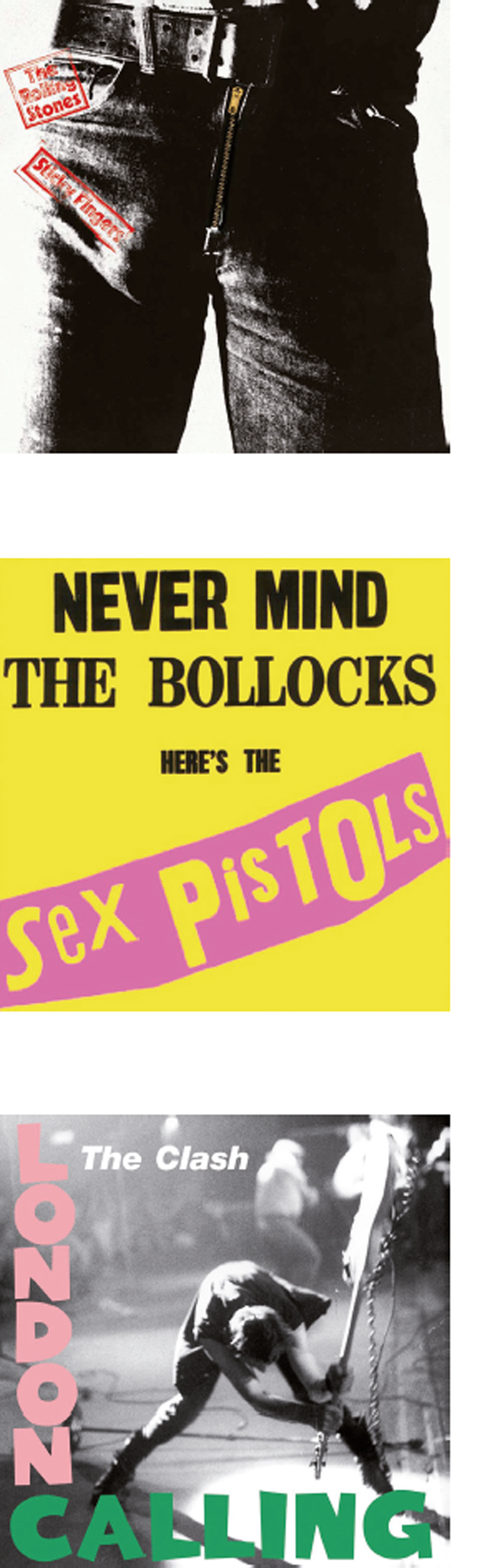

Covers illustrating this dossier are successful prototypes of an unprecedented and unique communication model the world over. Great trendsetter and conveyor of taste and style, the United Kingdom played its cards with irreverence and unpredictability

|

In the United Kingdom, there is no strategy supporting the development of the bioeconomy. Despite the fact that, potentially, it could be the world-leading country, there are still several political, economic and social barriers hindering innovation in this field. As Caitlin Burns, Adrian Higson and Edward Hodgson write in a document published in January 2016 entitled “Five recommendations to kick-start bioeconomy innovation in the UK,” “practical measures are needed to close the existing gap with the United States, Brazil, France, Italy, Germany and Scandinavian countries.”

Burns and Higson are two consultants fro NNFCC, a York-based company established by the UK government in 2003, specializing in the bioeconomy; Hodgson is a researcher at the Aberystwyth University in Wales.

Their recipe to make the bioeconomy thrive across the Channel is simple, at least on paper. Here are the ingredients: a cross-sectoral and long-term approach; supporting a clustering process on the model of what has been done in Yorkshire with BioVale; technological transfer, from the laboratory to the pilot plant and up to marketing; a system of green public procurement. Lastly, raising public awareness and acceptance of bio-based products.

Tertiarization of the Economy

Tertiarization of the Economy

Today, the United Kingdom seems to be paying the tertiarization of its own economy in the bioeconomy field. The UK is the sixth economy in the world – the third in Europe – with a nominal GDP of $2,945 billion and a pro capita one of $45,000 in 2014. The service sector is the main driving force, contributing for 4/5 of GDP, followed by the industry (around 20%), while agriculture participates only marginally, with less than 1%.

According to an analysis carried out in June 2015 by Capital Economics, one of the world’s main independent companies on macroeconomic research, the bioeconomy’s gross added value across the Channel is £153 billion, with over four million jobs, including satellite activities. This ranks the United Kingdom as Europe’s fourth country behind Germany, France and Italy. Another study conducted by Banca Intesa Sanpaolo’s research centre has estimated that the UK’s production value for the bioeconomy is around €171 billion, employing 888,000 people, thus placing it in fifth position in Europe, because in this case even Spain is ahead thanks mainly to the contribution of agribusiness.

Centrality of Industrial Biotechnologies

However, thanks to innovation, growth potential is enormous. Chemistry Growth Partnership, a public/private initiative created within the strategy to boost chemistry launched by the government in 2013, estimates that the national economy would benefit from £8 billion by 2030, if the chemical industry used biomass as raw material. It would also grow by £4-12 billion a year if industrial biotechnologies were employed. According to a governmental report, from 2009 to 2013, the turnover of the industrial biotech sector grew by 11% and employment by 5%, annually.

So, it is no coincidence that the main initiatives to create new businesses in Great Britain are linked to biotechnologies.

Two examples have gained considerable visibility over the last few years: Celtic Renewables and Biome Bioplastics. The former is a Scottish biotech company using whisky dregs to develop advanced biofuels and other biochemicals: in 2015, it was awarded the EuropaBio prize (European association for the bioindustry) as the most innovative SME in the field of industrial biotechnologies. The latter is a Southampton-based company producing biodegradable and compostable bioplastic.

Waiting for a National Strategy

The Industrial Biotechnology Leadership Forum – an association bringing together industries, investors and institutions – carries out the functions of the government’s advisory body with regard to the bioeconomy.

“The United Kingdom – continue Burns, Higson and Hodgson – has the potential to be a world centre of innovation in the bioeconomy, thanks to the presence of various factors: strong basic research, several cutting-edge companies from a technological viewpoint, active support by investors, networks and institutions. It is imperative, though, that a national strategy and an ensuing action plan be established.”

We cannot deny, though, that there is a vision and initiatives by the government. Last year, the Minister for business, enterprise and energy published a document – “Building a High Value Bioeconomy. Opportunities from Waste” – which places the bioeconomy development within the circular economy paradigm.

The vision to 2030 is very clear: making the United Kingdom one of the world’s leaders in the field of the bioeconomy, thanks to the nationwide presence of waste-based commercial scale plants, to the ability to attract investments from the rest of the planet and to the availability of technologies and business models to export the world over.

As for the bioenergy sector, in 2012, London introduced a strategy (UK Bioenergy Strategy) envisaging the use of biomass as mandatory in order to meet the targets of the UK’s decarbonisation by 2050. “Excluding biomass from the energy mix – as the British plan reads – would significantly increase the cost of decarbonisation of our system. A cost estimated at around £44 billion (according to an analysis by the Energy Technologies Institute, editor’s note).”

In short, the government’s strategy, which will be reassessed in 2017, enshrines clear, transparent and enforceable sustainability criteria, supports the use of energy crops and wood as raw material, pays attention to avoiding negative impacts on food prices and on biodiversity, promotes research of new technologies.

The Scottish Initiative

The Scottish Initiative

The Scottish government is not sitting idly by. Scotland was the first UK country, and one of the first in Europe, to present its own strategy for the circular economy. Announced last February by the Minister for the environment, Richard Lochhead, it will allocate €70 million between national and European funds to reduce considerably food and building waste (representing 50% of all Scottish waste). As stated by Lockhead, reducing food waste by only one third – one of the targets by 2025 – could add £500 million to the national budget.

In January 2015, “The Biorefinery Roadmap for Scotland” was presented, a document highlighting, with a ten year horizon, the action and support required to place Scotland as a country able to promote sustainable industries onto the global market. The key element of such document is the national Plan for industrial biotechnologies, aiming at increasing the turnover of such sector from £189 million of 2012 to £900 million in 2025 which – in order to achieve such goal – in 2014 led to the launch of IBioIC (Industrial Biotechnology Innovation Centre). Glasgow will be the city hosting the next edition of EFIB, the European forum for industrial biotechnologies and the bioeconomy, scheduled from 18th to 20th October 2016, thus showing how much attention Scotland is paying to industrial biotechnologies.

According to Alan Wolstenholme, Chairman of the Scottish Industrial Biotechnology Development Group, “the target for the next ten years is the exploitation of natural resources, of technologies and innovation, of basic skills and business networks to push the development of the bioeconomy to lead the agenda for a low-carbon country. A robust and versatile bio-refinery sector – notes Wolstenholme – will spur Scottish manufacturing and will act as a beacon for European businesses looking for collaboration or rearrangement.”

Vivergo: The Biorefinery in Sync with its Surroundings

This is the way Paul Mines sees it too, Biome Bioplastics CEO and a member of the management committee of Lignocellulosic Biorefinery Network (LBNet), a British government-funded network made of industrialists and academics, leaders in the generation of economic value through chemical processes, materials and innovative fuels using lignocellulosic biomass as an alternative to oil.

“With the rising production of biofuels and bio-based chemicals – claims Mines – lignocellulosic technologies are an important solution enabling to use non-food crops for such processes and the development of efficient and sustainable methods to satisfy chemical and material needs in the world.”

Today, the UK’s leading biorefinery is Vivergo, a joint venture created in 2007 by Ab Sugar, British Petroleum and DuPont, which in 2015 witnessed BP’s withdrawal, which sold its shares to Associated British Foods, thus making it the majority shareholder. Indeed, BP, in June 2014 expressed its intention to invest in American advanced biofuels, complaining about the lack of consistency and stability of European legislation. US-based Butamax Advanced Biofuels – the joint venture created in 2009 by the British oil colossus in partnership with DuPont for the commercialization of bio-butanol – has its commercial plant in Brazil.

The Vivergo plant – located within the Saltend Chemicals Park near Hull – in Yorkshire, started to produce in 2012, becoming fully operational in December 2014. It is one of Europe’s leading plants for the production of bioethanol, meeting about a third of the UK’s demand for its blending with petrol. Moreover, such plant produces up to 400,000 tonnes a year of high-protein feeds. Such quantity is enough to feed over 340,000 milking cows daily, i.e. 20% of national dairy livestock.

Vivergo’s aspiration is to become a biorefinery in sync with its surroundings, stocking up on the wheat it needs as raw material mainly from Yorkshire and Lincolnshire farms. The plant, according to what the company itself claims, saves over 50% of greenhouse gases compared to normal petrol, equivalent to current annual emissions of over 180,000 cars in the United Kingdom.

“Our business – points out David Richards Vivergo’s general director – is a great example of sustainable economic growth, because we ensure precious raw materials such as bioethanol and feeds which we would otherwise have to import.

“Our location just on the Humber river – adds Richards – is ideal: we are at the heart of the UK’s wheat belt, with the world’s best yields. Moreover, our distribution channels for bioethanols, by boat or road, to warehouses where it is blended with petrol are second to none.”

Green or Bio: It’s a New Economy

Waiting for a new strategy on the bioeconomy – clamoured by those in the field – that launched for the green economy in 2011 will do, where the government stresses the need for the UK to move away from the use of fossil sources: “The UK is becoming increasingly dependant on fossil fuel imports. By 2020, we will be able to import 45-60% of our oil and 70% of our gas. At the same time, global demand will probably rise, causing restrictions on the supply and price volatility. The United Kingdom must become more resilient to these price variations, developing alternative supply sources and using natural resources more efficiently.” If this is not a strategy, it is certainly a manifesto favouring the bioeconomy.

C. Burns, Higson A., Hodgson E., “Five recommendations to kick-start bioeconomy innovation in the UK”, BIOfpr, v. 10, n. 1, January/February 2016; onlinelibrary.wiley.com/doi/10.1002/bbb.1633/full

Capital Economics, The British bioeconomy, June 2015; www.bbsrc.ac.uk/documents/capital-economics-british-bioeconomy-report-11-june-2015/

Chemistry Growth Partnership; ukchemistrygrowth.com/Partnership.aspx

Industrial Biotechnology Leadership Forum; connect.innovateuk.org/web/industrial-biotechnology

“Building a high value bioeconomy. Opportunities from waste”; tinyurl.com/kv28uut

UK Bioenergy Strategy; tinyurl.com/j5n2552

The Biorefinery Roadmap for Scotland; tinyurl.com/zdfhkmk

EFIB 2016; www.efibforum.com/news/2015/glasgow-to-host-leading-biotechnology-conference

Lignocellulosic Biorefinery Network; lb-net.net/

BioVale: Yorkshire and Humber lead the British Bioeconomy

Yorkshire and the Humber is the leading region of the British bioeconomy, thanks to the BioVale project, the first cluster bringing together companies, universities and research centres committed to this meta-sector, which has also benefitted from funds by the European Regional Development Fund.

BioVale was set up in July 2014 with the aim to build an internationally-recognized centre for bio-based innovation, focused on renewable raw materials and agricultural technologies, able to attract investments and to promote sustainable economic growth.

Technological transfer, access to international funds and networks, specialized training and institutional relations are amongst BioVale’s main activities.

The Yorkshire and the Humber region is actually the UK’s most important cluster of the bioeconomy, representing about 10% of its total value with £9 billion and 105,000 people employed. According to some estimates carried out by the London government, by 2025, investments in BioVale should lead to the creation of 45,000 new jobs and an added value for the economy of £2 billion a year.

Overall, in this UK area, there are 14,000 companies, active within the bioeconomy, over 450 chemical businesses (10% of the UK total) and more than 11,000 companies in agriculture, forestry and fishing. Vivergo biorefinery and the Drax Group biomass-operated power plant, which, with 3,960 megawatts provide 7% of the UK electricity are based here. Here, there is also the greatest concentration of food businesses in the UK. Lastly, the port system on the Humber River estuary is the busiest in the UK and the fourth in Europe for tonnage.

BioVale, www.biovale.org

The Scottish Industrial Biotechnology Innovation Centre

Launched in 2014, the Industrial Biotechnology Innovation Centre (IBioIC), headquartered in Glasgow, was set up to bridge the gap between education and industry.

It is specialist in the industrial biotechnology sector, with a deep embedded knowledge and the technical expertise to help stimulate the growth and success of the industrial biotech industry in Scotland by connecting the dots between industry, academia and government. Its vision is to create a truly distinctive, world-leading innovation centre for industrial biotechnology. IBioIC acts to accelerate and de-risk the development of commercially viable, sustainable solutions for high-value manufacturing in chemistry-using and life science sectors. By 2030 its target is to generate £1 to £1.5 billion of gross value added contribution annually to the Scottish economy, this represents a growth of revenue from today’s estimated value of £190 million, to between £2 and £3 billion.

The IBioIC has outlined five key themes that would be adopted as the initial areas of focus for the centre and the success of industrial biotechnology development in Scotland:

1. Feedstocks, using sustainable biomass to replace fossil fuels;

2. Enzymes and Biocatalysts, to increase the use of biocatalysts/enzymes for new product development and efficiency benefits;

3. Cell Factory Construction, develop facilities for optimisation of new strains;

4. Downstream Processing, the development of products to get easily recoverable product streams;

5. Integrated Bioprocessing, full utilisation of raw materials and production of several co-products.

Scottish Industrial Biotechnology Innovation Centre, www.ibioic.com

In the United Kingdom the First Bank for Green Investments

In line with its role as Europe’s major financial markets, the United Kingdom can boast the first bank in the world entirely devoted to green economy. It is the Green Investment Bank, set up and completely controlled by Downing Street and capitalised with public funds. The bank carries out a key role in the environmental sustainability strategy of the country, requiring – according to what has been disclosed by the bank itself – investments for £330 billion until 2020.

The Green Investment Bank deals with many sectors including waste and bioenergy. Here are a few of the projects in which the British bank has invested in 2015:

- £47 million (for an overall investment of 107 million) for a domestic and commercial waste-operated energy plant in Northern Ireland able to provide electricity to 14,500 houses;

- £70 million, together with the Irish utility Esb Electricity Supply Board, in an overall project of 190 million for the construction of a renewable energy facility in the port of Tilbury in Essex (Tilbury Green Power Facility). It will be able to generate – from the beginning of 2017 – 300 GWh of electricity a year, serving over 70,000 households. The facility is powered by 270,000 tonnes of waste a year, recovered in the surrounding area, provided by Stobart Biomass company;

- £21 million for the biomass-operated renewable energy facility (for an overall investment of 138 million) of Estover Energy at Cramlington, in North East England. It is estimated that it will cause a reduction of greenhouse gases equal to withdrawing 25,000 cars from the UK streets for a period of twenty years. The plant will provide energy to local pharmaceutical companies and will be able to guarantee electricity and heating to the local community (213 GWh of electricity from renewable sources, enough for 52,000 households a year);

On 3rd March 2016, the UK government expressed its will to privatize the Green Investment Bank. According to Downing Street, “A transfer to the private sector will allow the GIB to maximize investment into green energy projects by attracting greater private sector investment, which has so far been constrained by rules governing how public bodies can raise capital.”

Green Investment Bank, www.greeninvestmentbank.com

New Bioproducts from Whisky Dregs, from Beer to Fish

Scotland is known the world over for the quality of its single malt whisky, beer, fish and shellfish caught in its waters. All resources for the fledgling bioeconomy. According to a study on the circular economy, focused on these commodity sectors (“Sector Study on Whisky, Beer and Fish, Final Report”), published in June 2015 on an initiative by the Scottish government, the total volume of production waste is high and can become raw material for the production of new biofuels o bio-based chemical intermediates. As many as 53,682 tonnes of beer, 4,371 million tonnes from whisky and 189,538 tonnes from fish and molluscs.

A high percentage of such waste has always been used as feed for local animals and for fish, or as fertilizers on the fields or to produce heat or energy. However, over the last few years, Scottish people started to use this waste also to produce advanced biofuels, bio-based chemical intermediates and food supplements for human health. According to government’s estimates, the potential economic benefit for the Scottish economy linked to the use of such waste is of £595 million a year.

Against this backdrop, the most significant example is that of Celtic Renewables, a spin-off of Biofuel Research Centre of the Edinburgh Napier University, which developed a technology to transform whisky production residue into car biofuel. The technology is now being experimented at the BioBase Europe Pilot Plant in Ghent, Belgium, thanks to the funds obtained of €1.5 million, of which over one million granted by the British government, aiming at a new market sector in the United Kingdom with an estimated turnover of €125 million a year.

Celtic Renewables, www.celtic-renewables.com

Images:

Joy Division, Unknown Pleasures, 1979. Debut album of English new wave, design by Peter Saville, Factory Records

Led Zeppelin, Led Zeppelin, 1969. Debut album by the English rock band, design by George Hardie, Atlantic Records

The Beatles, Sgt. Pepper’s Lonely Hearts Club Band, 1967. Eighth album by the band, design by Jann Haworth and Peter Blake (countless parodies), Parlophone

Pink Floyd, Dark Side of the Moon, 1973. Eighth album by the English band, design by Hipgnosis, Harvest Records

The Rolling Stones, Sticky Fingers, 1971. Album signed by Andy Warhol and design by Craig Braun, Rolling Stones Record (self-produced)

Sex Pistols, Never Mind the Bollocks, Here’s The Sex Pistols, 1977. The only official album by the punk rock band, design by Jamie Reid, Virgin Records

The Clash, London Calling, 1979. Double live album by the band, self-produced design, it evokes Elvis Presley’s first album cover. CBS Records

Interview with Maggie Smallwood, BioVale Director

Interview with Maggie Smallwood, BioVale Director

Edited by Mario Bonaccorso

We Have More than One Trump Card

The UK Bioeconomy is based on its world leading knowledge base.

Maggie Smallwood talks to Renewable Matter. An interview with the Head of BioVale, the cluster which promotes Yorkshire and the Humber as a thriving centre of successful innovation for the bioeconomy and helps regional enterprise profit from the valuable business opportunities in this high growth sector. With her we talk about the bioeconomy in the United Kingdom, its strengths and its weaknesses.

As far as you’re concerned, what are the strengths of the bioeconomy in the UK?

“Probably one of the UK’s greatest advantages is its world-leading knowledge base. This should allow us to innovate our way to new biobased products and services. In Yorkshire, we already have examples of spin-outs from our higher education system which are doing this. For instance Keracol, a company based in the University of Leeds, has developed methods to extract natural molecules from vine wastes; Starbons, a spin-out from the University of York, has patented technology to make a biomaterial from starch with wide ranging applications; Floreon has developed a biobased additive that makes bioplastic more robust based on technology developed at the University of Sheffield. We also see global leaders coming to the UK to access the knowledge base: for instance Brazil comes to the University of York to access their world leading expertise in the plant cell wall to accelerate their development of advanced biofuels.

Another advantage is that the knowledge base is reasonably well connected to industry through Innovate UK’s knowledge transfer network, the BBSRC (Biotechnology and Biological Sciences Research Council, editor’s note) Networks in Industrial Biotechnology and regional networks such as BioVale. Industry can access scientific equipment and innovative scale up facilities which even large companies can not afford through centres such as the Biorenewables Development Centre in York and the National Industrial Biotechnology Facility on Teeside.

The UK is also fortunate in being home to major multinationals such as Unilever and Croda who understand the opportunity which the biobased economy offers as well as innovative SMEs such as Biome, a company which is working to make bioplastic from lignin, a residue from the paper and advanced biofuel industries.”

And the weaknesses?

“A weakness in the UK is perception of the bioeconomy. First people often don’t understand what it means and second there is a lack of appreciation of its scale: a study by Capital Economics estimated the annual gross value added arising from the UK bioeconomy in 2012 at £153 billion. This value is spread across the country, unlike some industries that are highly concentrated geographically.

Because the use of bioresources for manufacture of chemicals, fuel and materials is an emerging sector, connections are missing between industries in these new supply chains.

The UK is a small country and we do not have the type of biomass resources that other countries enjoy, such as the vast forests of Scandinavia. This means that we need to focus on adding value to byproducts and wastes.”

Some people in UK complain about the lack of a specific strategy on the bioeconomy? Is it a subject on the agenda of the government? What measures should contain the plan to give practical support to the bioeconomy, from your point of view?

“The Biological and Biotechnology Sciences Research Council, BBSRC, and UK government departments have commissioned a review to look at just this question. BioVale is working with the Biobased Industries Association (BBIA) and with several of our network’s innovative SMEs to analyse the type of policy support they need to grow.

Policy stability is probably the most important factor to support development of a strong bioeconomy. Production of chemicals and materials from biomass is often both environmentally beneficial and adds more value that the use of biomass for bioenergy or biofuel. Extension of the policy support for biofuel and bioenergy to biobased chemicals would ensure that the latter was not disadvantaged.”

In your opinion, how does the strong development of the tertiary sector affect the bioeconomy in UK?

“The bioeconomy needs a service sector – legals, project management, marketing, finance – in a manner comparable to the petrochemical economy. Many of the skill sets will be transferable so strength in the tertiary sector can be applied to the bioeconomy both in the UK but also across the globe.”

BioVale is the first UK cluster dedicated to bio-economy. What is your role in supporting the bioeconomy?

“Building on its world-class strengths in the bioeconomy BioVale aims to establish Yorkshire and the Humber as an internationally recognised centre for bio-based innovation, focusing on renewable raw materials and agricultural technology. Working with collaborators such as UKTI and the Foreign Office’s Science and Innovation Network as well as our European Cluster partners in the 3Bi consortium, we promote the region’s bioeconomy assets to export markets, investors, policy makers, and funders.”

Can your case be replicated in other parts of the country?

“Yorkshire and the Humber has an outstanding combination of bio-based research, industry and agriculture, giving it a distinctive advantage, however, there are definitely opportunities for other regions to develop their bioeconomies using similar approaches. Our cluster has chosen to focus on four priority areas where our cluster stakeholders have world leading strengths: adding value to biowastes, next generation fuel and chemicals, high value chemicals from plants and microbes and agricultural technology. Other regions will have different priorities that reflect their local industry and agriculture. The basic principles of strengthening connections between elements in the new biobased supply and innovation chains can be applied anywhere.”