In the circular economy one of the most controversial sticking points is the supply of material to recycle or regenerate.

As William McDonough outlines in this issue of Renewable Matter, waste should not be considered necessarily and only as a negative externality with a powerful effect on environment and health. Rather, it needs to be seen as a “raw” material of great value, scarce (in terms of economics) and subject to strong competition for its use.

Hence, supply is a key factor and it requires clever design of the whole supply chain. Often, though, collecting “quality” refuse is anything but simple.

Renewable Matter analyses several case studies in order to show how, in different sectors, industry is getting equipped to create an industrialized supply chain. That of used oil regeneration is a model of success.

Italy is the leader in this sector, with over 90% of lube oils collected and used to produce regenerated base oils re-introduced on the market. Re-refined products are considered on the same level as those from primary refineries, thus creating positive competition between the two worlds. The remaining 10% is not regenerated and is used as fuel for cement factories, while a minimum amount undergoes thermal destruction. Lubricant oils used for combustion are “non-renewable matter,” with pollution levels that prevent them from qualifying under the strict laws governing the chemical properties required by used oil if it is to be regenerated.

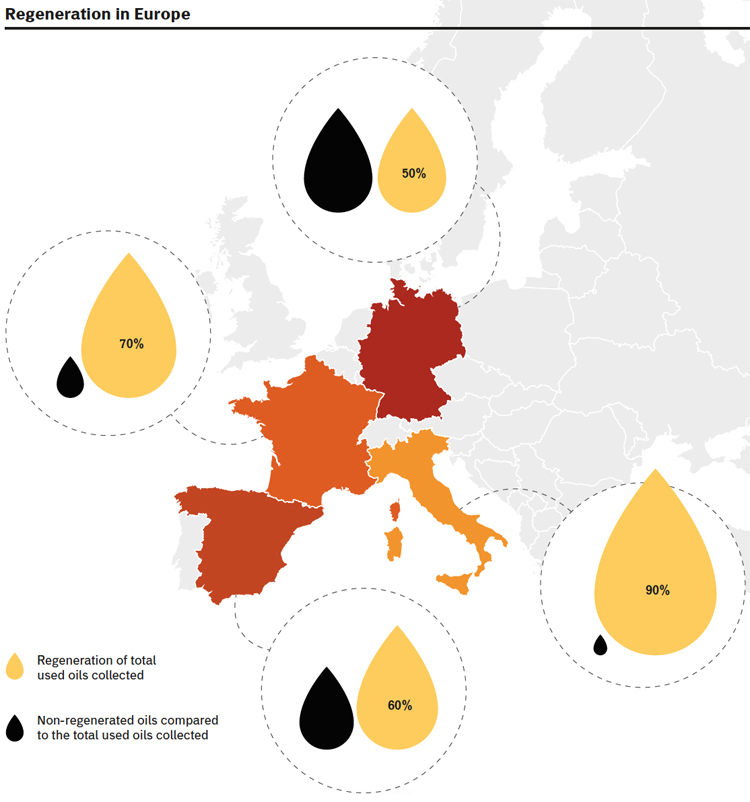

The regeneration process greatly reduces the impact on the environment, lowers the amount of raw material (crude oil) consumed, thereby cutting emissions produced in the extraction phase and the need for transportation and refining. One ton of regenerated lubricant base produced using advanced technology reduces CO2 emissions by at least 40% compared to first refinement. Data for several European countries give an idea of the extent of the regeneration supply chain of used oils, revealing at the same time significantly different performance rates. In France, about 70% of all oil used is regenerated, about 60% in Spain, while Germany, the heart of heavy industry and car manufacturing, regenerates only half the oil it collects. In Italy, in 2013, out of 171,000 tonnes of waste, a good 155,000 was reintroduced on the market in the form of regenerated base oils. A little known all-Italian primacy.

Undoubtedly, these results were aided by the regeneration law: according to COOU, the obligatory consortium on used oils, it is a fundamental lever for the circular economy. National legislation as regards the handling of used oils is the result of how EU rules are received. All lube oil collected is analysed and Italian law promptly establishes the criteria that determine its destination. In Italy, therefore, the legislation that regulates the sector also decides how it is used. While this is undoubtedly a positive factor, alone it is not enough to determine the success of collection. “Over 20 years, the lubricant market has diminished by 40%. The effect of this trend has been a considerable reduction in the availability of used oil,” explains Marco Codognola, engineer and director of the Environment, Purchasing and Business Development Division of Viscolube, Italian leader in used lube oil re-refinement. This reduction in supplies has shifted the attention to the waste supply chain for one essential reason, namely that the flow of renewable used oil to the refineries has to be constant.

“Supply stability in terms of type and quantity,” comments Codognola, “is a key factor if we are to optimize the regeneration process of used oil and maximise efficiency and quality of recycled products.”

The industrial and economic situation is a factor that can affect the supply system of waste: a decline in domestic industrial production corresponds to a proportional decrease in the availability of used lube oils.

This is a well-known phenomenon at Viscolube, which had to face the severe economic and industrial crisis of 2008-2014. On the one hand, the closure of many Italian companies and the general decline of industrial production (in Italy it decreased by almost a quarter from 2008 to 2013) have reduced the amount of used oil available. On the other, the car industry, another source of strategic importance to re-refining companies such as Viscolube, saw the introduction of increasingly efficient engines with reduced consumption of lubricant. At the same time, there has been a general reduction in car use. Oil is changed less frequently, and, finally, we are using more vehicles with lower oil consumption (such as electric cars).

“For us, as for many companies that use waste as a raw material, there needs to be a suitable purchasing process at the base of a complex industrial process. So we considered it strategic to take part in this stage of the process,” adds Codognola. “With our fifty years’ experience in the management and regeneration of used oil – and thanks to the know-how of the companies that collect it – Viscolube decided to move into the collection and management of hazardous waste.” To achieve this, we created Viscoambiente, a business unit dedicated to the collection, management and treatment of hazardous waste. Viscoambiente’s goal is to integrate hazardous waste management, offering its customers the widest choice of environmentally sustainable services.

“Consolidation of the Italian sector of hazardous waste through the construction and optimization of a domestic player with increasing capabilities for collection, logistics and recycling is part of our plans,” says Codognola. “In this perspective, Viscoambiente ensures the group’s refineries a part of the waste they need. The unit started in 2013 and has so far acquired five companies, while others are under negotiation. We have collection companies in Piedmont (Settimo Torinese), Veneto (Vittorio Veneto and Verona), in Friuli (Palmanova) and Emilia Romagna (Bologna). The quantity of used oil obtained in this way now represents about 12% of the total amount we receive. The remainder is bought by all the other companies operating around the country.”

Today, Viscoambiente has a turnover of around €25million. The basic idea is to have an industrial structure for the collection: without this, the process is less integrated and more complicated.

Finally, as far as supply sources are concerned, Codognola states: “The Italian quantity of used oil is not always sufficient to guarantee optimal plant functioning. Therefore we recover a part from France and other countries. About 10% of the total amount of used oil regenerated by our refineries comes from areas abroad where regeneration capacity is lower than the quantity of used oil collected. Each member state of the EU, however, has specific legislation and given that it is hazardous waste, we prefer to obtain the raw material locally, following the principle of proximity.” Favouring supply based on resources produced locally is doubly effective economically and environmentally since it reduces costs and emissions from transport.

Therefore, recycling of used oils is a field of excellence but with problems yet to overcome. “Certainly, one of these being a lack of awareness of the priority the Commission affords to the regeneration and recycling of waste in the hierarchy established by the Waste Directive. It is a hierarchy that should be strictly applied in all countries, with no exceptions, allowing the indiscriminate burning of oil.”

And as for the Italian market? “We believe that where there are examples of excellence demonstrate that manufacturing quality product using regeneration is possible, spreading the habits of a circular economy and recycling is everyone’s duty, first and foremost that of the public administration, which could comply more strictly with the directive on Green purchasing.”

Info

Top image: illustrations by freepick.com, graphic elaboration