There is a ghost hovering around the world. Its name is “The Peak”. In a way, it is an obvious concept: if we exploit a non-renewable resource, its production is bound to start from zero at the beginning of its exploitation and go back to zero when such resource is completely exhausted. Between these two extremes, there is bound to be a point of maximum production, this can be called “peak production”. It is a general phenomenon affecting not only non-renewable resources but also renewable ones, if we exploit them quicker than they can be replenished.

So, understanding the mechanisms leading to peak production and their characteristics is crucial to comprehending that nebulous entity – nowadays called “civilization” – that could not exist in its current form without a continuous flow of cheap energy and resources. Resources presently coming mainly from the mineral kingdom.

When these flows must be reduced (in post-peak scenarios), what will happen to our civilization?

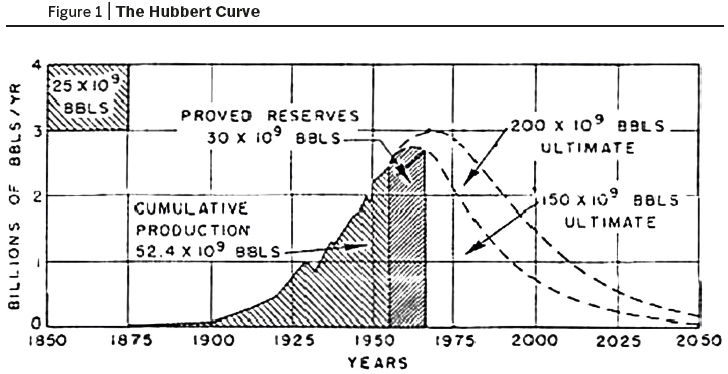

In order to understand the concept of peak, we must go back in time to when it was first introduced by American geologist Marion King Hubbert in 1956. Hubbert was an oil expert and according to his interpretation, Southern US oil production (thus excluding Alaska) would have followed a bell curve, reaching its maximum in 1970 and declining afterwards. This maximum level was the first example of peak for a resource.

Hubbert was challenged, insulted and in some cases worshiped for his forecast that proved surprisingly perfect when in 1971 US oil production peaked and then started its long decline. Moving on from this, Hubbert calculated that the world’s oil production would have peaked around the year 2000, an event later known as peak oil, a definition proposed by English geologist Colin Campbell. This forecast proved to be less accurate: in 2014 we have not seen the global peak oil, in fact oil production is still slightly increasing, thanks especially to “non-conventional oil” (shale oil and Canadian oil sands) that Hubbert did not take into consideration in his forecast because he was unaware of their existence.

Over five decades after Hubbert’s first presentation of his ideas, we can affirm that his theory has proved rather inaccurate in determining the peak date of a given resource. At the same time though, it has become a sort of “universal wrench” enabling us to interpret many historical trends of resource production; not only for oil and mineral resources but also for theoretically renewable resources when exploited faster than their regeneration rate.

There is a plethora of examples and so far one of the most famous cases of Hubbert curve is US whale oil production in the 19th century. The kind of whale hunted for this purpose (right whale) was pushed to the brink of extinction; presently its population is still nowhere near the numbers before the hunt started. The economic history of the world presents many such examples: coal mining in the United Kingdom and in other European countries, gold mining in California, mercury mining and the list goes on.

|

|

The Hubbert Curve as it was originally presented in 1956 in relation to the US oil production. Real production followed quite closely the curve (the highest one of the two represented in the diagram) till a few year ago when shale oil production boom changed the situation leading to a new production expansion phase that should peak in the next few years. Source: M.K. Hubbert, “Nuclear Energy and the Fossil Fuels”, Spring Meeting of the Southern District Division of Production American Petroleum Institute, 1956. |

The concept of peak has proved to be fruitful, in particular giving rise to a current of thought that is sometimes called “peakist movement” (a term not always seen as a compliment). Nevertheless, it has also remained “transparent” – or completely invisible – to the eyes of the public, politicians, policy makers and most economists. As Thomas Henry Huxley affirmed, “It is the customary fate of new truths to begin as heresies and to end as superstitions”.

It appears though that Hubbert’s Theory still belongs to the realm of heresies, or maybe not, since for the majority of people it simply does not exist. In reality, when discussing peak production, we are often faced with a situation where the so-called “abundantists” line up barrels of oil as if they were toy soldiers ready for battle, while “peakists” sometimes seem to think like those prophets that in the past preached the apocalypse. We are always faced with the quasi-insurmountable obstacle of spreading the concept of peak against the stern objection “but if oil resources are not exhausted, why should there be a peak?” Experience teaches us that it is not possible to proceed in this debate unless we offer a good explanation of the peak concept and its reasons.

First, peaking (of oil or of any other resource) does not mean that the resource is “exhausted” or that there is none left. We are talking about peak production, that is, the moment when it reaches its highest historical level. It does not mean that in the post-peak period such resource is not produced, it only means that its production is lower.

We must also remember that the peak of any resource does not spell apocalypse or disaster. Normally when in a region a resource peaks, it is replaced by another or by the same resource produced in a different region. This is what has happened with oil in the USA. As we said earlier, US oil production peaked in 1971, but oil consumption has increased thanks to rising imports.

Finally, we must also highlight the fact that peaking is not a physical law and it can be reverted. In many instances, reverting the trend of production decline has been possible by increasing investment. The USA provide us with a further example. After the 1971 peak, production kept shrinking until a few years ago, when this trend was reversed thanks to massive investments of the oil industry in shale oil extraction, a resource that was once considered too expensive to be exploited. This is leading the US production towards a second peak that could occur in the next few years.

So, once we have established what the Hubbert Peak is, we must understand what causes it. Why is it that so often the production of a resource follows such a well-defined curve? We can explain it as the result of the combination of two factors: one has to do with the laws of geology and the other with those of economy.

Geology tells us that mineral resources are not all the same. Every resource is present in fields with different concentrations (or “grades”), deepness and purity. The “easier” resources do not need a lot of work to be extracted and refined but the exploitation of “difficult” resources requires deeper mining and more complex processing in order to extract useful minerals. Just remember that at the very beginning of oil extraction, this resource could be found on the surface or just a few metres underground. Today we talk about kilometres and in very hardly accessible regions or at the bottom of the sea. This entails a higher financial and resource investment.

Now, let us combine geologic resources dispersion and the obvious economic principle of profit maximization. Clearly, there is a tendency to extract and exploit cheaper resources. At the beginning, extraction is relatively cheap; profits are high and are mainly invested in new search and extraction. This causes a rapid increase in production. Over time though, cheap stocks are exhausted so costs increase and profits fall. Consequently, less is invested in R&D of new resources. The rapid initial growth slows down until it stops. Production decreases after reaching its highest level, this is why there is a peak. This logic can be applied to any depletable resource, peaking is not confined to oil only.

|

|

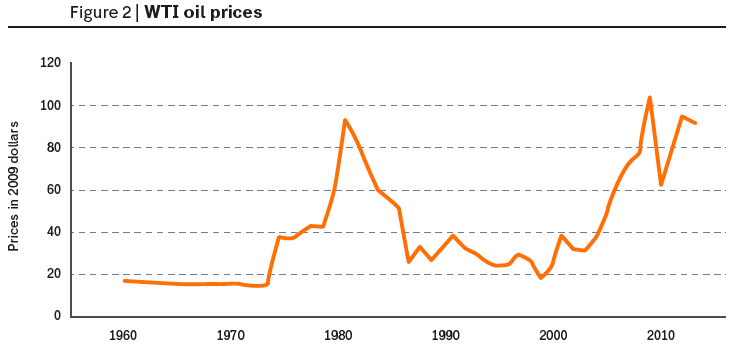

As seen in this diagram, oil prices have increased by a factor of 5 in the last few years, starting a trend that appears irreversible unless a serious economic crisis reduces demand substantially as it briefly happened in 2008 at the beginning of the economic downturn. Similar trends can be found in all mineral resources: prices increasing by a factor of 3-5 compared to levels considered “normal” until a few years ago. Source: Author’s estimate based on data from the Federal Reserve Bank of St. Louis, USA. |

It can be demonstrated with a mathematical model (see “A Simple Interpretation of Hubbert’s Model of Resource Exploitation”, http://www.mdpi.com/1996-1073/2/3/646) that the Hubbert Curve, symmetric and regular, occurs if producers keep reinvesting a constant fraction of their profits in searching for and extracting the resource.

This is obviously an approximation, but the fact that many historical cases present a similar curve means that in many instances this is what happens in reality. Naturally, the price mechanism can heavily influence production trends. It goes without saying that producers try to maintain their profits by increasing sale prices in order to compensate for rising extraction costs. In reality, the market can react to the perception of a vital resource shortage, such as oil, by raising prices. This generates an increase in profits and new investments, sometimes massive; as a result it is possible to counter a decline in production for a certain period. But not forever, because high prices tend to reduce demand, at this point the market shrinks and prices fall. A contraction of production follows. It is impossible to elude Hubbert’s Mechanism because, at the end of the day, it is based on a fundamental economic principle: the decreasing return on investment.

As seen so far, the mechanism that leads to a peak is applicable to all mineral resources: overtime, easy and cheap resources are exhausted, with extraction becoming increasingly expensive. This results in a general increase of costs. So far, we have not seen the beginning of the decline of any crucial mineral resource: the “peak of minerals” is still ahead of us, in the future, but perhaps not that far off. According to a 1972 study, The Limits to Growth, the peak should have been reached in the second decade of the 21st century. The mining industry’s effort to maintain current levels of production requires higher and higher investments and it is clear that it cannot increase ad infinitum.

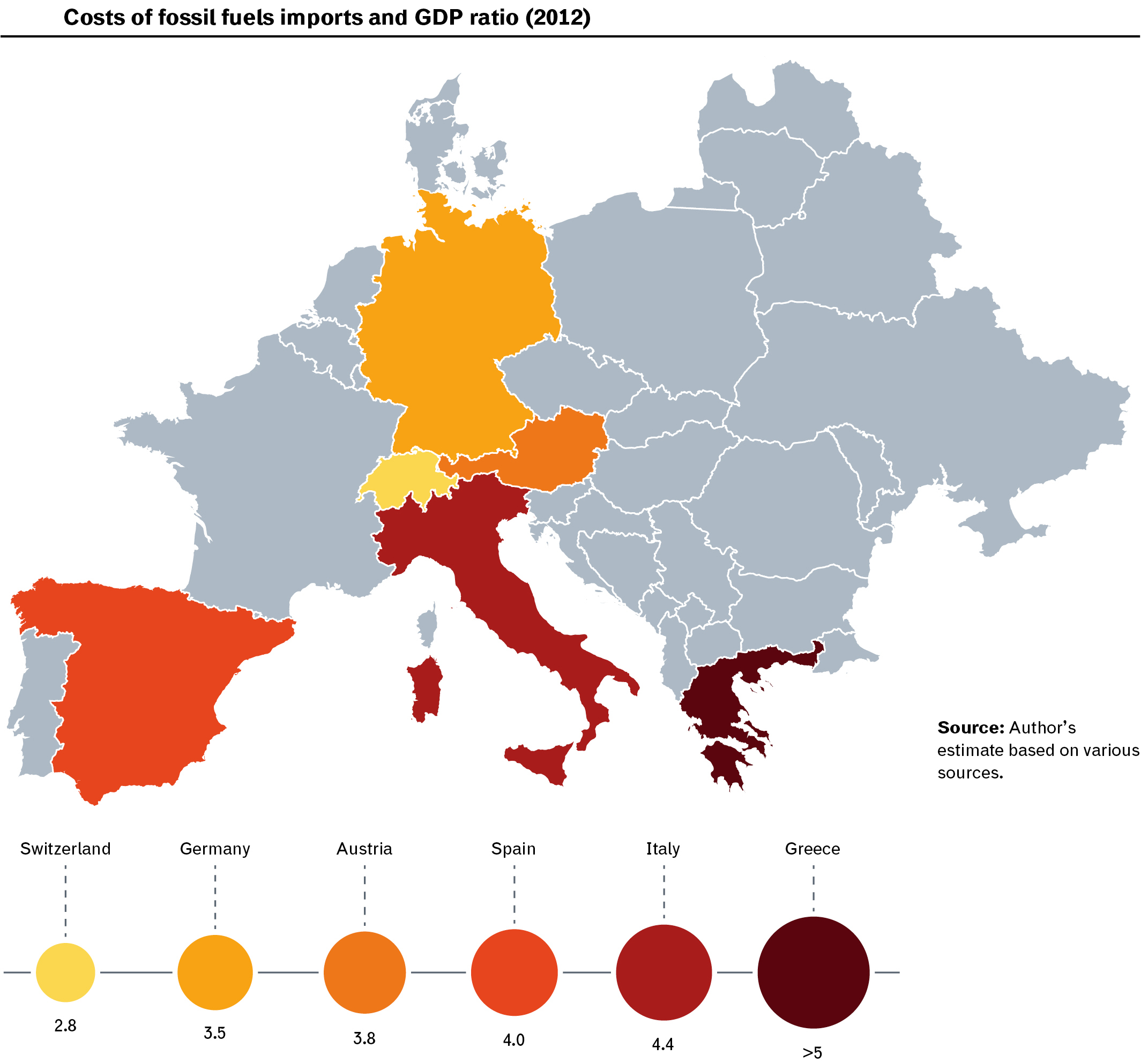

High mineral resources prices create problems, particularly serious ones, in countries that depend heavily on imports, namely countries with an economy based on transformation, processing imported raw materials and exporting finished products. This type of economy characterizes many European countries, including Italy. It can be argued that Italy’s deep economic crisis over the past few years is due to the heavy costs of its imports, particularly of fossil fuels, in an economy that is not as efficient as other European economies in using them.

|

What does the future hold? As usual, accurate forecasting is not possible. However, we can predict that the gradual exhaustion of cheap mineral resources will make production more expensive. Technological innovation, often portrayed as a panacea for solving depletion issues, can mobilize new resources but only if the productive system is prepared to pay high ensuing costs. Consequently, we are travelling a road leading to a world where past assumptions are no longer valid. For example, in the majority of cases, extracting a mineral resource was less expensive than recycling it. However, this could no longer be the case in the future.

In essence, there is no escape from a very simple concept. As described in Extracted, Club di Roma latest report, mineral deposits that we call “resources” are the result of energy provided by geologic processes that needed millions of years to concentrate dispersed materials on the Earth’s crust in forms that we are able to exploit. It is a “gift” given to us by the planetary system, but it is a one off.

Eventually we must learn how to manage mineral resources without thinking that they are free. This means learning how to recycle, reuse and use efficiently. It is possible, but it requires time and investments and we must abandon the idea that we only need “to dig deeper” to solve the problem.

Image: © Micha Klootwijk / Shutterstock.com