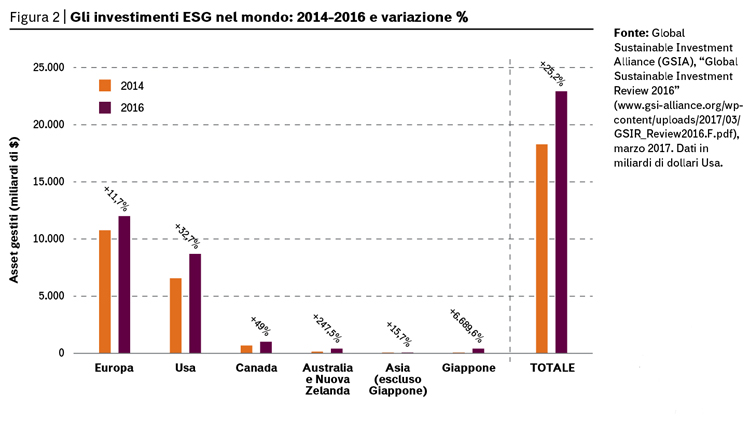

$22.890.000.000.000. Almost $23 trillion’s worth of banknotes. That’s the value of sustainable investments, as it’s been recorded at the end of 2016, the latest year for which we have definitive data. These were published last March in the most recent edition of the biennial survey of the Global Sustainable Investment Alliance (GSIA), a network of five different associations working in the field of responsible investments. The survey pointed out that in two years the value of ESG bank transactions (Environment, Social, Governance) has grown by 25%: these represent the assets selected by investors across the Planet according to one or more sustainability criteria (including environmental, social and responsible management aspects).

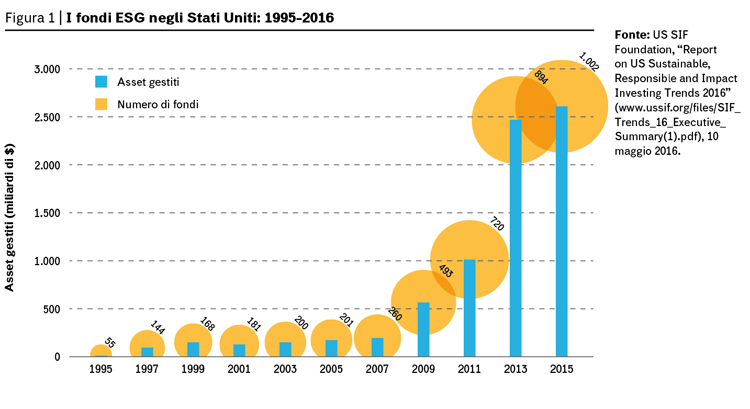

This trend confirms a long-term growth that by now has got deep roots. The growth of this sector in the United States is emblematic: the last USSIF study reveals that investment funds that integrate ESG criteria in the selection process of their portfolio assets have grown from 55 to 1.002. At the same time the value of their responsible investments has grown from $12 billion to $2,6 trillion.

The GSIA analysis shows that today ESG assets available on the American market sum up to a total amount of 8,700 billion, with a 33% increase compared to 2014. The market leader is Europe, with 12,000 billion assets under management and a lower but important growth rate of approximately 12% on a two-yearly basis. The Canadian market is undergoing a very significant 49% growth, and Australia is recording a dramatic 248% growth in the same period. The most astonishing result belongs to Japan that contrary to the rest of Asia, shows an unprecedented growth: in 2014 the value of ESG investment in Tokyo and the surrounding area amounted to a poor $7 billion: now it has reached $474 billion dollars, with a 6,700% increase.

What are the key-factors behind this growth? In other words, what pushes investors to adopt with increasing frequency ESG criteria when defining their strategies? Global political choices in the environmental field, which culminated with the signature of the climate agreement, surely represent part of the answer, and so does the development of the green economy and the growing attention for circular economy strategies. But it seems there’s something more: a specific element, a resource can make these strategies more attractive, “quantitatively” speaking. The strongest hypothesis is that this integration of the ESG factors brings not only to a positive impact in terms of sustainability, but that it also offers better financial performance.

This hypotheses is supported by Savita Subramanian, director of the U.S. Equity and Quantitative Strategy of Bank of America Merrill Lynch Global Research sector. In a report published at the end of 2016 he pointed out how 80% of the funds managers he interviewed and who applied sustainability criteria in their investment management, motivated their choice with the higher returns. Specifically, of the companies that were quoted in the S&P Common Stock index, those with the highest ESG ratings had 5% higher returns compared to those with a lower rating. Subramanian highlighted that the spin-offs were also evident in risk management: “An investor who purchased only stocks with above-average ESG ratings would have avoided 90% of the bankruptcies we’ve seen since 2008.” The advantages in terms of risk management emerge strongly even in the circular economy: already in June 2015 in particular, an enquiry run by the British think-tank Green Alliance had pointed out that higher investments in the field of materials recycling and energetic efficiency could create a higher resilience compared to the price volatility of the raw materials market. This is a phenomenon that has become evident in the first post-crisis years.

At the current stage, the connection sustainability/performance find the strongest confirmation in the environmental field. “From a theoretical point of view it’s been demonstrated that funds that select their portfolio according to environmental sustainability criteria do not have lower yields than conventional funds, provided that the investment universe is wide enough” explains to Renewable Matter Leonardo Becchetti, professor of Political Economy at the University of Rome Tor Vergata. “Moreover, empirical studies have highlighted top results achieved by investors that were able to anticipate the environmental policies implemented in the last years, and focused on companies that were able to perform better, compared to their counterparts in the fossil compartment.” And what about the future? “The big challenge for the years to come – explains Becchetti – consists of making social sustainability and fiscal responsibility economically viable as well.” The mechanism should be the same that has already been experimented in the field of environmental sustainability, that is a mixture of bottom-up pressure from the investors and at the same time, a top-down regulatory pressure. In September 2014 for example, more than 120 investors with managed assets worth more than $10 trillion have signed the so called Montréal Carbon Pledge, a document supported by the Principles for Responsible Investment (PRI) and by the United Nations Environment Programme Finance Initiative (UNEP FI) where investors aim at measuring, making public and reducing the environmental impact of their portfolio. “At the same time – reminds Becchetti – the announcement of the Chinese, Indian and Dutch governments has raised expectations for a more severe regulation of private transport, for the benefit of the development of electric cars. The great financial performance of a company like Tesla proves that the market has already started rewarding the revenues expected from the company in the coming years. As for the circular economy, he adds “since it’s part of the principle of environmental sustainability it’s likely that it will prove to be a winning choice: institutions can do much in this direction, creating effective incentives, for example in the field of taxation.”

Selection strategies

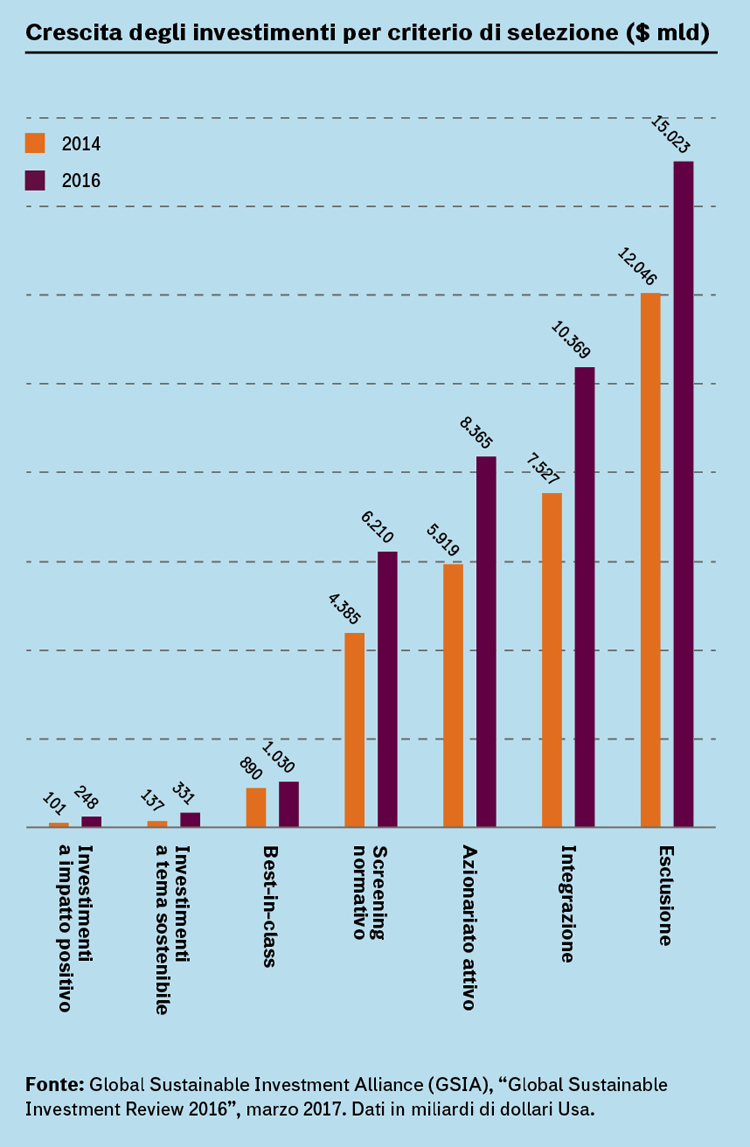

According to analysts, investors use seven strategies to evaluate the sustainability of portfolio assets. The most common is the Exclusion of holdings from investment universe, that implies the choice of not investing in a sector or in a company whose business is inconsistent with ESG criteria or with international regulatory standards. According to the last GSIA survey, the value of portfolios of investment that exclude one or more categories of “problematic” securities (weapons, tobacco, nuclear etc.) amounts to $15 trillion, 3,000 billions more than 2014 data. On the other steps of the podium are the so called ESG Integration (10,400 billions), that is the explicit and systematic integration of ESG factors in the traditional financial analysis, and the Engagement and voting on sustainability matters (8,400 billions), that implies the operators’ commitment to promote ethical social and environmental concerns in the companies they invest in. The list of strategies also involves Norms-based screening (the companies’ compatibility assessment through the minimum standards of business practice based on international regulation), the Best-in-Class investment selection (investments with the highest ESG scores in their sector), the Sustainability themed investments (in energy efficiency, renewable energy and so on), and Impact Investing, which involves investments with a positive impact in terms of social or environmental development.