Recently, Lisa Jackson, Apple’s vice president of Environment, Policy and Social Initiatives, made an unnoticed but major statement. She announced that Apple’s goal was to eliminate the need to mine new materials from the Earth and, to reach that goal, Apple would ensure that its products will last as long as possible.

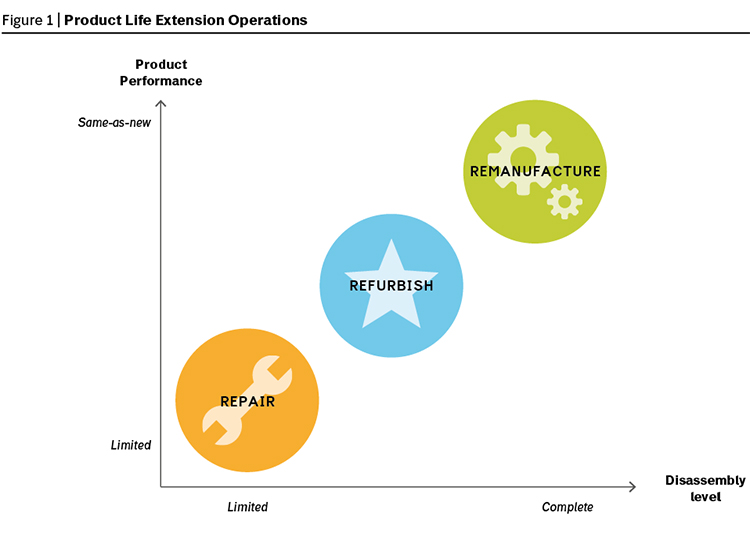

Apple is actually not the first company making products last. Manufacturers of heavy assets, such as aircraft, trains, or construction equipment, have been doing this for decades. To ensure their products last as long as possible, manufacturers have to design them to last. But this is not enough: they also need to, regularly, extend the use-life of their products. For this very purpose, they can, either directly or through third parties, remanufacture, refurbish or repair their products, each operation having its own benefits and potential drawbacks (see Figure 1).

Remanufacturing is a standardised industrial process by which used products are returned to “same as new” conditions. It involves dismantling the product, restoring and replacing components, testing the individual parts, reassembling and testing the entire product so as to ensure that it is within its original design specifications. For example, Renault remanufactures its engines, John Deere the components of its tractors, Rockwell Automation its electrical equipment, and SKF its bearings.

Refurbishing aims to bring used products up to specified quality. Quality standards are less rigorous than those for remanufactured products. Following disassembly of used products into modules, all critical modules are inspected and fixed or replaced. Approved modules are reassembled into refurbished products. Philips Healthcare refurbishes its medical equipment, HP its computers, Samsung its smartphones.

Repair aims at returning used products to “working order.” The quality of repaired products is generally less than the one of refurbished products. Product repair involves the fixing or replacement of broken parts. Other parts are not affected. Repair usually requires only limited product disassembly and reassembly. For example SEB Group, a manufacturer of small domestic appliances, has committed to the reparability of its products for 10 years. In order to support the repair of products outside their warrantee period, the Group ensures that some 36,000 different spare parts remain available to repair centres for ten years.

Selling the Same Product Twice

Many companies believe that products that last longer are not replaced frequently and, therefore, do not generate revenues. Very often, this is inaccurate. First, the market for refurbished and remanufactured products is growing in various product categories, allowing manufacturers to sell the same product twice. For example, the global refurbished and used mobile phone market is projected to register an expansion at 8.9% CAGR between 2017 and 2025. In addition, long lasting products enable businesses to increase their customer base. For example, because they last, iPhones could be resold once or even twice. Therefore, Apple can expand its audience by a factor of two or even three and increase sales of services such as Apple Music or Apple Pay. Manufacturers of lasting products can also adopt subscription models, getting a competitive advantage over suppliers of low-cost products. Because their tyres last longer, Bridgestone and Michelin have been able to sell tyres-as-a-service instead of tyres-as-a-product. Finally, businesses can leverage new technologies to improve refurbishing operations and reduce their costs. Ermewa, an industrial railcar and tank container leasing services company, uses wireless sensors and the digital platform from Amsted to improve repair depot cycle times and implement a condition-based maintenance programme.

The Hidden Giant

Surprisingly, the remanufacturing, refurbishing and, to a lesser extent, repair sectors remain unknown. In most countries, the terms “remanufacturing” and “refurbishing” are not defined, preventing their use in commercial contracts and legal texts. The is no French translation of the word “remanufacturing” while, in North America, the remanufacturing market is often called the “hidden giant.” Yet, making products last longer is not new. Ford has been remanufacturing its car engines since 1930, Caterpillar the mechanical parts of its construction machinery since 1973, Xerox its printers since 1987. Remanufacturing, refurbishing and repair also come hand in hand with major economic, environmental and social benefits. For example, a remanufactured engine can be produced with up to 83% less energy and up to 87% fewer carbon dioxide emissions, while raw material consumption can be reduced by up to 90% compare to a new engine. Remanufacturing, refurbishing and repair also create local qualified jobs. Caterpillar Remanufacturing & Components division counts 17 sites and more than 4,000 employees.

Some organisations are working hard to promote remanufacturing and refurbishing, such as the Conseil Européen de Remanufacture (see What Does the CER Do?) or the Automotive Parts Remanufacturers Association (see What Does APRA Do?). Today, as they demonstrate major economic, social and environmental benefits, remanufacturing, refurbishing and repair need to be better supported by governments, businesses and, also, consumers. Thanks to them, products are not just consumables anymore, they become assets, our assets.

What Does the CER Do?

Interview with David Fitzsimons, European Remanufacturing Council directorWhat is the Conseil Européen de Remanufacture (CER)?

“A few years ago, the European Union funded a Horizon 2020 project called ‘European Remanufacturing Network’ to bring together the fragmented pieces of research concerning remanufacturing across Europe. The project conclusions highlighted the need for an organisation that would help represent and better coordinate remanufacturing businesses in Europe, like the Remanufacturing Industries Council in America or the National Key Lab for Remanufacturing in China.

The Conseil Européen de Remanufacture (European Remanufacturing Council) was set up in January 2017. It is a consortium of manufacturers who want to advance the European remanufacturing agenda. It brings together companies from various product sectors such as IBM, Michelin, Panalpina, SKF or Volvo. Its ultimate goal is to move the value of the European remanufacturing sector from €30 billion to €100 billion by 2030. In the future, the Council will coordinate with similar organisations around the world with the aim of making remanufacturing a normal part of a product life cycle.”

How do you compare the European market with the American one?

“Roughly, within a given region, the remanufacturing market value is typically somewhere between 1,5 and 3% of the manufacturing market. This ratio has been verified in all countries where the size of the remanufacturing market has been measured, such as in Europe, America, Japan or South Korea. Based on these numbers, the remanufacturing market sizes are similar in Europe and America. However, today, the definition of remanufacturing is a little uncertain and those numbers may not be comparable. My general impression is that the American market is better organised, and better understood than the European one. It is probably because aftermarket activities, especially for vehicles, seem to be more important in America. On the other hand, I suspect that the market is comparatively much smaller in China, were the potential for growth is significant.”

What Does APRA Do?

Interview with Daniel Koehler, Chairman of APRA Europe

What is APRA Europe?

“APRA is the Automotive Parts Remanufacturers Association. Established in 1941, it is the only global association that represents the interests of the entire automotive remanufacturing industry. APRA Europe, the European branch of the association, manages all European activities and represents members’ interests among EU institutions. Amongst our activities, we co-founded and ran several very appreciated networking events. We have the ability to block anti-remanufacturing regulation. We also developed a common definition for remanufacturing, which is now the baseline for a lot of drafts and discussions regarding legal regulations and laws. A lot of laws only relate to scrap or new products. Remanufactured products and used products are unknown, which leads to a very foggy legal situation. We are clarifying this for our members, but it is a very long process that runs over decades.”

What are the main opportunities and challenges of the European remanufacturing market?

“Remanufactured products are in many cases the only second source and alternative to increasingly complex and highly integrated original equipment parts which cannot easily be copied, or reverse engineered by aftermarket manufacturers. There is also a growing awareness about the circular economy. For instance, garages in France are required to offer an alternative to a new product, such as a remanufactured component. There are also new product groups, such as hybrid and e-car components and batteries, that are entering the remanufacturing market.

Obviously, the market also knows some challenges. Remanufactured products face an increasing competition from new aftermarket products at low prices, such as starters and alternators. Especially in the passenger cars business, there is heavy competition with extremely low-priced imported products which show a reasonable aftermarket quality. There is also an ongoing and accelerating technology shift from mechanics to electronics/mechatronics which urgently requires new know-how and experts.”