Just over 10 years ago Sir Richard Branson, founder of the Virgin Group, vowed to donate over $3 billion to fight global warming by developing low carbon fuels, and in particular a seaweed-based biofuel for aeroplanes. In an exclusive interview with the BBC in 2008 he advocated for: “A fuel that doesn’t affect our food security […] fuels such as algae-based biofuels that can be grown and don’t eat into the food supply.” Influenced by the surge in crude oil prices between 2003 and 2008, and subsequent boom in plant-based biofuels, interest in developing alternative fuels became a priority. In this context, algae biofuel emerged as the next big thing, a biofuel that didn’t impinge on food security.

However, to date algae biofuel production is less than one million gallons per annum and still nowhere near having a competitive market price, leading the decade starting from 2005 to be dubbed the “Algae biofuel bubble.” Promising companies that had received millions of dollars in funding in the early 2000s (Solazyme, XL Renewables, Aurora Biofuels and GreenFuel Technologies, to name just a few) have either gone bust or expanded into higher added value products such as food, food additives, cosmetics, speciality oils and animal feed.

Today, interest has moved on from seaweed as a biofuel to the potential of seaweed as a raw material with a variety and cascade of applications. Today, the most promising application for seaweed continues to be as a food source (either as a direct food or as an additive/thickener): in this sector, its production generates the most added value and currently holds the largest seaweed market share. However, the animal feed and bioplastics sectors are also growing, and are particularly promising if seaweed is produced in a circular framework, where all parts are used, thus limiting waste and maximising value. In fact, Professor Sander van den Burg – researcher at the Wageningen University in The Netherlands and leading expert in sustainable development, business innovation and seaweed – believes that the seaweed market has grown hugely over the last couple of years, largely driven by the food sector and that, “the cascading of [seaweed] biomass must become the future for this industry.”

From Biofuel to Seaweed Super Food

A major influence in the promotion of seaweed in the food sector has to do with mounting concerns surrounding food security. It is predicted that global food production will have to grow by 50-70% by 2050 to maintain current consumption trends (World Bank 2016). Therefore, promoting the consumption of seaweed represents an important contribution to food security. FAO data reveals that over 6 million tonnes of seaweed are already consumed annually around the world, with all the largest markets situated in Asia: 5 million tonnes in China, 800,000 tonnes in Korea, 600,000 tonnes in Japan (van den Burg 2016).

In Europe, seaweed is gaining a foothold as a direct food source for human consumption in the health and wellness foods sector, which is expanding and looking for new products that meet consumer demands. According to the United Kingdom’s Food and Drink Federation, the British organic food and beverages market has grown 6% since 2016, versus a 2% growth of the non-organic one, and in the European Union (EU) sales in organic produce rose almost 50% between 2012 and 2016.

This expanding sector is fertile ground for seaweed-based products. However, in Europe companies need to accompany consumers by educating them on their uses and benefits. Van den Burg highlights this issue by emphasising how these new companies currently, “spend a lot of time explaining to consumers what to do with their products. This is necessary. You cannot simply dry your seaweed, put it in a package and leave it there: consumers need to be supported and educated as well.”

|

|

Seamore, a Dutch company producing seaweed-based foods, embodies this approach. It combines eye-catching marketing with strong efforts towards educating consumers on the benefits and potential applications of seaweed

|

From Food to Feed

The second largest use for seaweed is as a direct source of nutrition or as an additive to existing feeds both in livestock farming and aquacultures. This market is also promising from an environmental standpoint as these are large industries that process huge amounts of raw materials. For example, the total amount of soy used in the Netherlands for feed equalled 2,353,000 tonnes between 2010 and 2011 (van den Burg 2016). Producing that same amount of feed using seaweed would imply a significant reduction in the land, water and resources used to grow crops traditionally fed to animals. In fact, van den Burg claims that, “the Dutch dairy industry would be an interesting market for seaweed-based feed.” Not only does seaweed have a high protein content but at low levels of inclusion (less than 2% of dry matter intake), it can exert a significant prebiotic activity, thus improving animal health and increasing production without the risk of livestock developing antibiotic resistance [Evans & Critchley 2013].

Aquaculture also benefits substantially from seaweed use, which is especially important as global production of farmed fish has surpassed that of beef, in a 14-fold growth since 1980. For example, MicroSynbiotiX Ltd, winner of the 2016 Blue Economy Challenge, focuses on creating a microalgal feed that acts as a vehicle for a variety of vaccines, thus reducing the need for antibiotics.

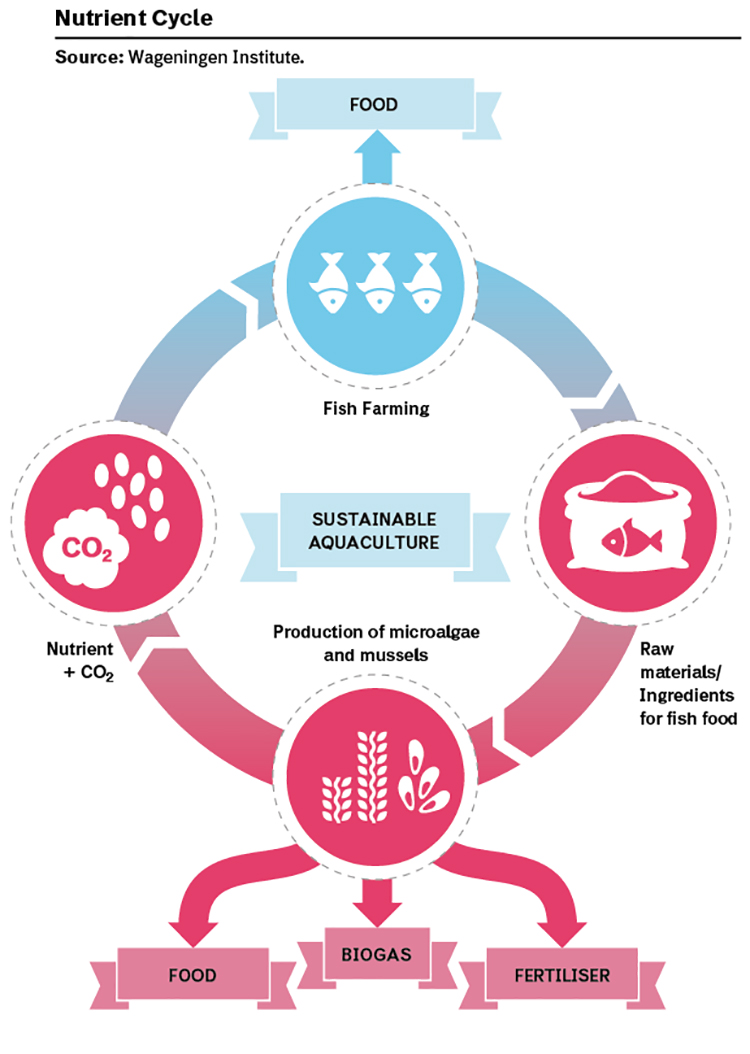

However, seaweed’s greatest potential contribution is embodied in a truly circular approach to its production: integrated multi-trophic aquaculture (IMT). IMT unites animals and plants from different trophic levels into the same space, so that aquacultures can function as actual ecosystems. The confined spaces of aquaculture systems in which fish are bred and raised often lead to high levels of pollution in surrounding waters. Growing algae in their vicinity provides mutual benefits: seaweeds obtain the nutrients required for their growth whilst helping improve the quality of water the fish rely on. Therefore, in IMT the circulation of nutrients occurs in a closed loop. Furthermore, the benefits of IMT are not just confined to seaweed that is produced for feed. In fact, by generating large amounts of seaweed biomass in IMT systems the potential for seaweed as a component in bioplastics (and potentially biofuels) is beginning to look economically feasible.

The Problem of Plastics

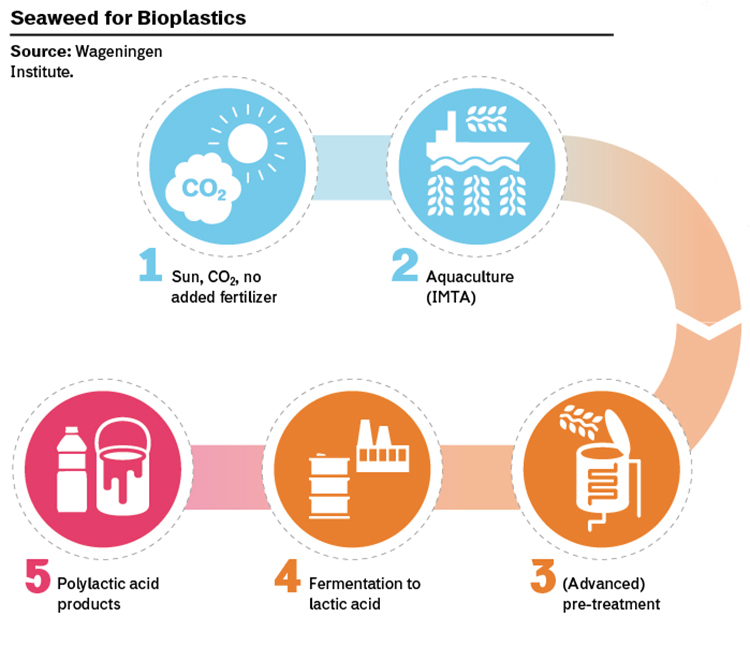

Mankind has produced more than 8 billion tonnes of plastic since 1950. Europe alone generated 58 million tonnes of plastics in 2015. Growing concern over the impact of plastics on our health and environment (and in particular marine pollution) has led to increased interest in bioplastics. One of the major contributors in the development of bioplastics is PolyLactic Acid (PLA), a sustainable alternative to fossil fuel-based polymers that is both compostable and biodegradable. However, most of the production of PLA and other biopolymers currently relies on plant-based materials such as corn, wheat, sugar beets and sugar cane, thus threatening food security by putting food and feed crops in direct competition with the manufacturing of bioplastics. In fact, the European Bioplastics association claim that: “the industry is committed to tap new renewable resources and move away from foodplants [and] is fully aware that the sustainable sourcing of its feedstock supply is a prerequisite for more sustainable products.”

Seaweed is thus emerging as a potential alternative. Van den Burg sees bioplastics as “one of the main areas of future interest for seaweed-based products.” Companies such as Evoware and Skipping Rocks have been working hard to consolidate biodegradable plastic packaging made from seaweed. Skipping Rocks, founded in 2013, has actually come up with a product that can replace plastic bottles with biodegradable, and even edible water bottles. Although van den Burg claims that “the bioplastics sector is not driving the seaweed market for now […] it does have potential.”

In fact, the potential of seaweed as a bioplastic is particularly interesting when seaweed is produced with IMT systems. Research by the EU-funded Seabioplas project has explored the circular potential of integrated seaweed production systems. Its research shows how over 67 to 80% of nitrogen and 50% of phosphorus fed to farmed fish is released back into the environment, either directly from the fish or from solid waste. The seaweed feeds on this nitrogen and phosphorus, thus removing the excess whilst generating extra biomass. This not only benefits the seaweed and removes polluting elements from the water but also, when compared to other raw materials used in bioplastic production, implies fewer CO2 emissions, higher productivity, no risk of potential deforestation, and no consumption of freshwater or fertilisers and pesticides. Furthermore, after seaweed has been used to generate PLA the residues can be used as valuable by-products in animal feed, or food supplements/additives. This is incredibly significant as utilising by-products means both minimising waste and maximising profitability (and hence the economic feasibility) of seaweed bioplastic production.

|

|

Evoware

|

I Sea a Circular Future

Current research on the feasibility of seaweed production for bioplastics and even biofuels generally focuses on the single-uses of seaweeds. Combining different applications through approaches such as IMT, as well as developing the market for seaweed-based food and feed products, could be fundamental developments in bolstering seaweed production. However, more data and research on our ability to use a cascade of applications, such as the extraction of valuable hydrocolloids, functional food additives and use of remaining material as feed ingredient or for bioplastics is required.

In the words of Paulien Harmsen, Biorefinery expert at the Wageningen Institute: “Seaweed farming can become a large industry in Europe if we can produce a broad range of products from the same biomass. If we employ the cascade approach and master commercial biorefining the market for this sustainable industry will be huge.”

MicroSynbiotiX Ltd, www.microsynbiotix.com

Evoware, www.evoware.id

Skipping Rocks, www.skippingrockslab.com/index.html

Top image: Skipping Rocks’ biodegradable and edible water container. Credit: Skipping Rocks